A look into Argentina´s pig production

JULIO CALZADA - FEDERICO DI YENNO - CARINA FRATTINI

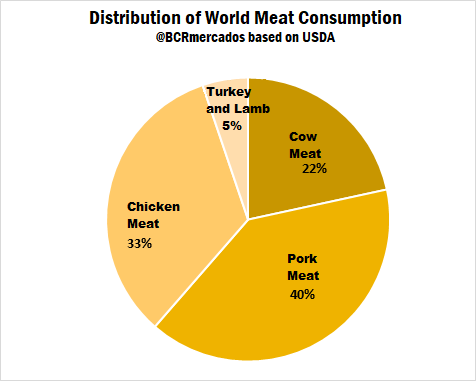

The pig is an important sector for the internal consumption of corn: assuming that 60% of the pigs´ diet in Argentina contains corn, in 2017, corn consumption by the pig sector reached 1.25 million tons. There are enormous possibilities in the future to develop and consolidate pork production in our country. In 2017, according to the Argentine Association of Pig Producers, the consumption of pork in Argentina reached 14 kg / inhabitant / year, divided into 11 kg of fresh meat and 3 kg of cold meats and sausages. In comparison, beef consumption reached 57.2 kg / inhabitant / year, four times higher. Argentine domestic consumption of meats is very different from the world consumption composition. In 2016, 40% of the total meat globally consumed was pork. Except for certain countries, pork and chicken tend to be the most consumed meats in the world.

The pig sector in Argentina is small but has optimal natural and sanitary conditions to grow, be self-sufficient and export. Argentine pigs´ health is internationally recognized as very good. It is free of the main diseases that affect the species: CSF - Classical swine fever, PRRS porcine reproductive and respiratory syndrome, Aujeszky's disease among others. Sanitary regulations are satisfied and there are numerous controls: trichinosis, influence, aphthous and tuberculosis. Even so, Argentine pig foreign trade does not look good. Indeed, pigs´ trade balance was in deficit in 2017. This is so because pork (and related products) exports approached USD 15 millions while imports exceeded USD 118 million, according to data from the National Statistics Institute (INDEC). Comparing with the rest of the world, the country was placed in 2016 in the position No. 54 of the world ranking of exporters of pork products, with a very low participation of 0.002% in global trade while, for example, Brazil and Chile represented about 5 and 2% respectively. If Argentina's pork imports are observed, 85% comes from the neighboring country of Brazil. A large part of these shipments is frozen boneless pork meat. Argentine production in equivalent tons to beef, was 566,276 in 2017, showing a year-on-year increase of more than 8%. The activity has numerous intrinsic advantages, such as the availability of corn and soybeans, which is the main cost of production, the favorable climate, the lack of health threats and the necessary production scale that favors their regional development. Assuming that 60% of the diet of pigs in Argentina contains corn, in 2017 the consumption of corn by the pig sector would have reached 1.25 million tons. The slaughter´s volume has been growing in recent years at a rate of 8%. Our country has 249 porcine processing establishments in the country. The production of pork meat is mainly destined to the domestic market. Approximately 40% of the total production is produced by five establishments, which have the highest industrial and technological development in the sector. Four of these are located in the province of Buenos Aires.

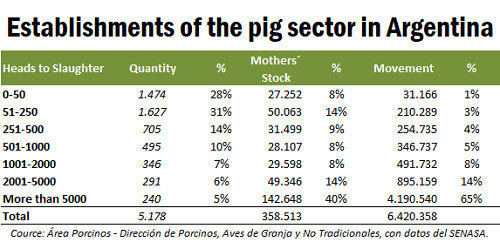

The geographical distribution of primary pig production establishments marks its highest concentration in the north of the province of Buenos Aires, south of Santa Fe and the center of Córdoba. The location corresponds to the implanted area of maize and the distribution of balanced food processing plants, one of the main inputs of primary production. Pig production is strongly concentrated. The largest establishments that operate more than 2000 animals (which represent 11% of the total of the breeding establishments) participate with 79% of the total of the slaughter (about 5 million heads). These plants have 54% of the stock of mothers nationwide (about 192,000 mothers), as can be seen in the attached table. Despite this, there is a high heterogeneity of actors, if we consider the total volume of establishments amounting to 5,178 productive units. This shows that there is a significant presence of small producers in the primary and industrial stage. They coexist with larger intensive facilities, with modern technology and better sanitary conditions, which have integrated the primary and industrial stages.

Most of Argentine pork producers (73% of the total, around 3,800) operate at a very low scale: less than 500 heads per year sent to slaughter, which is equivalent to an average of 1.5 heads per day. These small-scale systems do not allow the incorporation of state-of-the-art technology and more efficient systems, they make it difficult to standardize quality (meat), and they have a higher cost of negotiation and high tax informality. The problem is that the international meat market demands large volumes, with constant supply. This atomization prevents the development of a more aggressive export strategy. The main destination for the pig meat obtained in slaughter is the elaboration of sausages and cold meats, and in the case of high quality piglets, its main destination is fresh consumption.