Last decade’s changes in the ranking of oilseed crushing companies in Argentina

There has been a decrease with respect to the figure reported a year ago, but the decline is due to modules that were deactivated in the companies of this agroindustrial sector. The processes of outstanding changes tend to take place over longer periods, so what happened from one year to the next is of relative significance and responds to the conjuncture. Therefore, the comparison of the present with the scenario of the capacities of 5 and 10 years ago is made in order to perceive the most significant changes.

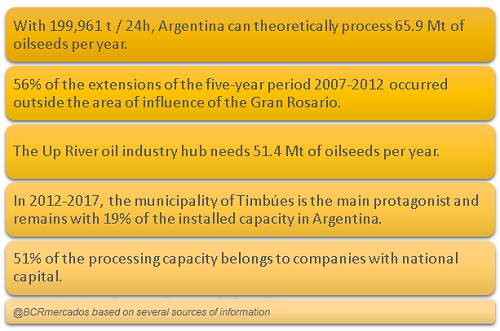

As mentioned in the previous week's article, the active installed capacity in Argentina increased by 7% in the period 2012-2017 and was the lowest relative increase registered among all the countries of the Expanded Mercosur. The same conclusion would be made if we observe the evolution in the last decade, since Argentina recorded the lowest percentage variation with 28 pp. However, this look in relative terms can be misleading since the scale of Argentina with respect to its neighbors is only comparable with Brazil.

56% of the extensions of 2007-2012 were made outside the Up River's areaReturning to the Argentine industry, the five-year period 2007-2012 was the one that experienced more significant net changes when adding more than 30,000 t to the total active capacity, which is equivalent to an increase of 19.4%, to add 186,381 t. More than half of that increase - some 17,000 t - occurred in regions other than the large Up River oil hub.

When talking about net changes, reference is made to the resulting balance between what goes into production by installation or expansion of the plant and what goes out of production by disaffection or closure of the processing module, total or partial. For example, in that period, some of the following changes occurred:

Aceitera General Deheza S.A. (AGD) added 11,000 t per day to the 6,000 t existing in General Deheza and subtracted 3,700 t when the Dalmacio Vélez Sarsfield plant went out of production.

Bunge S.A. put into production 3,000 t / 24 h at the inauguration of the Ramallo plant and added tonnage to the Tancacha facility.

Viluco S.A., belonging to the Lucci Group, installed a 3,000 t / day plant in the Santiagueño de Frías industrial park.

Nidera S.A. inaugurated the plant in Timbúes with 9,500 t / 24 hours and expanded capacity in Puerto Gral. San Martín and in Saforcada, 11 km from Junín.

Timbúes gains prominence and sneaks between Puerto San Martín and San Lorenzo

If we had to characterize the last decade in terms of processing capacity, we could say that four central issues appear:

The birth of a new city as protagonist: Timbúes. 69% of the expansion of the national processing capacity from 2007 to 2017 (29,500 t / 24 h over a total of 43,600 t / day) was centered in that Santa Fe district, now part of the agro-industrial oil hub of Gran Rosario. With the 37,500 that it had at 2017, it concentrates 19% of the active oil capacity of the country and is positioned between Puerto General San Martín, which participates with 22%, and San Lorenzo, which has 18% of the national total.

Four increases or new facilities with considerable capacities that, jointly, amounted to 22,500 t / 24h: one, in the plant that belonged to Nidera in Puerto General San Martín for 4,500 t; two, the 3,000 t that Bunge installed in Ramallo; three, the 3,000 t of Viluco en Frías; and, four, the 11,000 t that AGD added in Deheza.

The disaffection of modules or production lines in different plants and locations, for some 15,000 t / 24h, of which 63% would have corresponded to facilities in the area of influence of the Gran Rosario. Not necessarily in the port plants.

The business movement, which has been transforming the ranking of the ten main companies in this agro-industry and pushed those of national capitals to have a greater participation.

National companies with 51% of the processing capacity

It should be noted that not necessarily, the theoretical active capacity is equivalent to effective processing, but it is an indicator of the position of the enterprise in this agro-industry. In that sense, it is worth observing the evolution of the ranking of industrial capacity of the first ten business groups according to three moments in time; the present, 5 and 10 years ago. This positioning, in fact, is highly coincident with the positioning of the same business groups in the external sales (see pie chart).

Regarding the table with the ranking, we should make some clarifications, which correspond to the situation in mid-2017:Molinos Río de la Plata S.A. and Molino Agro S.A. they are two different companies, but in both the majority shareholder is the Perez Companc entrepreneurial group.

Although the theoretical processing capacities are attributed to the company that owns the plant, when it is managed by another, this capacity is assigned to the company which managed the plant. This is the case of the installation of Buyatti in Puerto General San Martin that was operating Molino Cañuelas (MOLCA).

The installation of COFCO Argentina S.A. that, with the acquisition of Noble and Nidera globally, left her with the Argentine assets of both companies.

For this 2018, some factors will change the figures of the ranking. This is the case of Cargill S.A., which is directly operating the Quebracho, Villa Gobernador Gálvez and Bahía Blanca plants, because at the Quequén plant there is a fagot agreement between Cargill and Renova. The extension in 10.000 t more of the capacity of processing of Renova is pending, that would be ready for the second semester of the year and would changes the position of OMHSA and Vicentín. On the other hand, COFCO Argentina reactivated the Saforcada plant, with 2,000 t / 24h, and is processing sunflower.

The figures of the ranking may change again, but the characteristics of this agroindustrial sector will hardly change as long as the export orientation remains present, especially of products obtained from primary industry. They can be circumscribed to:

High concentration. The ranking of 2017 shows that 94% of the crushing capacity is concentrated in the first ten companies; if the first five companies are observed, their share is 69%. This characteristic of concentration is not surprising in an agribusiness with a highly directed profile to the export of products obtained from primary industry.

High scale. In the previous report, the plant scale was already much higher than the one in Brazil, which is the exporting country closest to Argentina in size. This also occurs when compared to Brazil.

Equipment for grinding different types of oilseeds.

Proximity of the client to production. To the extent that the main soybean producing area, the raw material par excellence of this industry, is close to the shipping terminals abroad, this allows the consumer to get closer to the origin, using a lot of the cheapest mode of transport, the maritime.