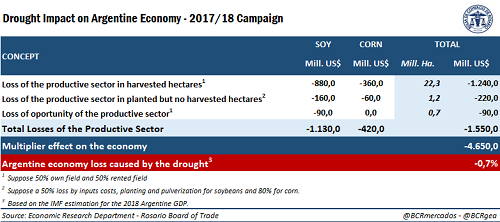

The drought that has been affecting soybeans and corn in the 2017/2018 production season will imply a fall in the Gross Domestic Product (GDP) of more than 4,600 million dollars for the Argentine economy, from which US $ 1,550 million correspond to direct losses of the productive sector. The cost of the drought for the Argentine economy, which is affecting the 2017/18 soybean and corn crops, already exceeds US $ 4,600 million, when not only the direct losses of the productive sector is considered, but also the fall in the activity of related sectors, such as transport, or the industries of machinery, construction, etc. This figure represents 0.7% of the Gross Domestic Product (GDP) that the International Monetary Fund (IMF) estimated in February for the Argentine Republic in 2018, valued at US $ 639,000 million. Breaking down this number, there are US $ 1,550 million that are directly attributed to the productive sector , and that are composed of both the lower profitability that will be obtained from the hectares that can manage to be harvested from soybean and corn and from the loss by inputs applied to the area that, having been sown, would not end up being harvested, as well as the opportunity cost in the hectares that did not manage to be sown in the absence of adequate conditions. Moreover, the lower income of producers working throughout the country will result in a smaller mass of resources to the rest of the economy, which translates into an additional national income loss of US $ 3.1 billions , once we consider the multiplier effect of spending on national economic activity as a whole.

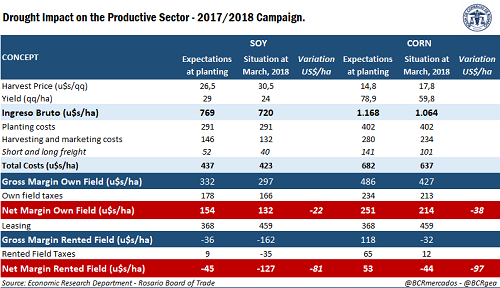

Considering that the agroindustrial soy complex leads the Argentine exports, with 75% of the soybean production crushed in each season to produce meal and oil, among others, destined mainly to the external market, based on the pattern of the last campaigns, the 15 Mt would have increased the crushing 2017/18 by 11 Mt and the exportable balance by 2.3 Mt for soybeans, 1.5 million for oil and 8 millions for soybean meal. At current export values, this means that Argentina missed out on obtaining a total foreign currency income of US $ 5.2 billions. 1-Direct losses for agricultural producers The rise in prices to harvest has not been able to compensate for the lower production of the agricultural sector as a whole, resulting in a loss of income with respect to the expectations with which the planting 2017/18 was faced. The price of soybeans to harvest in MATBA (Buenos Aires Futures Market) has increased by 15% since the producer made the decision to plant, while corn rose 20%. However, the national average of yields is projected 20% below the initial estimates of the campaign for the oilseed and 25% below in the case of corn. Thus, although the expenditures of the producing sector are lower in some items such as freight (since less merchandise is transported) or harvest services (since the lost surface increased), this is not enough to reverse the fall in the margins caused by the diminished productivity. The expected net profitability decreases in all cases, as shown in the attached table.

For soybean, a producer with his own field may be obtaining, on average, US $ 22 less per hectare planted, while in rented field the fall reaches US $ 81 / ha. For corn, the fall in net margin amounts to US $ 38 and US $ 97 / ha, respectively. In the global calculation of losses for the producing sector shown in the first table that accompanies this article, it is assumed that 50% of production is done under leasing and 50% in own field, when computing the losses for each hectare that the man in the field will harvest under the current conditions. For this concept, losses amount to US $ 880 million for soybeans and US $ 360 million for corn, where the difference is explained by the greater amount of area covered by the oilseed and with a drought with a broad level of coverage. Thus, the losses of the productive sector in hectares harvested amount between both US $ 1,240 million. On the other hand, the hectares that, having been sown, will not be able to be harvested as a result of the drought, which is estimated at 1.2 M ha. For the oilseed, in addition, 50% of the cost of inputs, sowing and pulverization is computed as loss while the cereal is computed 80%, since in the latter case the expenditures that must be made at the beginning of the productive cycle are proportionally greater. Thus, for this concept, the productive sector as a whole will be losing another US $ 220 million. Finally, the opportunity cost is imputed to the hectares that were part of the planting intentions but which, due to the lack of moisture in the soils, were left out of the production cycle. This mainly affects soy, adding a loss of US $ 90 million. Adding the three concepts, the total loss of the productive sector is estimated at US $ 1,550 million, as a result of the drought that plagues the Argentine countryside and has left large areas exposed to the lack of moisture needed to enhance the yield of the grains in their critical period. 2- Some considerations on the indirect and induced economic impact on national economic activity Regardless of the losses that agricultural producers will suffer due to the reduction in their gross and net margins, the drought also represents large losses for the agri-food and agribusiness sector as a whole and, therefore, for the national economy due to the negative economic impacts, whether direct, indirect or induced. Less production, lower exports and lower producer spending will ultimately mean that numerous sales, commercial, financial and service operations are not carried out. Producers will spend less in the national economy and invest less in equipment, machines and / or vehicles. It is likely that in the next campaigns less will be spent on inputs, labor, harvest, insurance, freight, marketing expenses, expenditures by structure and administration, etc., which will depend on the magnitude of the losses caused by the phenomenon. Whoever sells supplies or provides trucking services will see their income reduced and, consequently, spend less in their activity or in other sectors of the economy. The same will happen with the one who sells a pick-up or a planter. Consequently, this fall in the spending of producers will multiply in numerous commercial operations that will cease to materialize within the economy of the country, generating, in addition, a lower collection of national taxes (for example, VAT), provincial (for example Tax on Gross Income) and municipal taxes (right of registration and inspection), etc. This is part of what economic theory defines as the multiplier effect of spending , or the set of increases / reductions that occur in the National Income of an economic system (GDP) as a result of an external increase / decrease in consumption, investment or public spending. In this case, unfortunately, the effect will play against the national economy resulting in a fall in the added value of the Argentine economy of US $ - (4,650) million, which arises from the application of a multiplier estimated for the chains of value of Argentine soy and corn ii. Among the activities adjoining the production of grains most affected by the fall in production, and which explain the total amount of retraction of economic activity mentioned above, are: a) Cattle and meat production. b) Transportation / Freight. c) Oil industry, service stations in the interior of the country and other links that make the commercialization of gas oil. d) Agricultural machinery, equipment, pick-ups and vehicles. e) Inputs sales, storage and conditioning service providers, rural contractors. f) Providers of services associated with exported merchandise (customs brokers, brokers, stevedores, independent surveyors, quality laboratories, etc.). Providers of port and / or boats services (for entry rights, lighthouses and beacons and use of dock, piloting and pilotage, tugboats, toll for the concessionaire in the Paraná-Paraguay waterway, boat services by mooring and unmooring, supervision , maritime agents, courier, etc.) g) Payment chain. Need for flexible financing. h) Impact of the commercial quality of soybean for export as well as on the quality of the seed for the next season. i) Other macroeconomic effects. i When referring to economic impacts, reference is made to: Direct economic impact: Production (value added), gross and net income, profits and employment generated in those sectors that are direct recipients of the expenses and investments of agricultural producers. Indirect economic impact: Production (value added), gross and net income, profits and employment generated by those sectors that benefit indirectly from investments and from the expense of field men. That is, those that supply the sectors directly affected with the goods and services necessary for their activity. Induced economic impact: Production (value added), gross and net income, profits and employment that is generated thanks to the consumption of goods and services by employees or human resources of sectors that benefit, directly or indirectly, from investments and expenses of field men. It would also include other impacts that are generated outside of direct and indirect ones. ii The multiplication factor applied in the present is similar to that used in the corn value chain in the United States. It amounts to 3.5 and was estimated in 2009. When dealing with the Argentine case and incorporating soybean, a crop with a smaller multiplier effect than cereal, it has been conservatively estimated at 3. This figure coincides, in addition , with another study conducted for the soy value chain in Paraguay.