The harvest advance confirms new production cuts, particularly in soybeans

In the Rosario Board of Trade, the reference price reached a relative high of AR$ 6,495/t on previous week's Monday, but broke the trend and close on Thursday at AR$ 6,230/t, cutting the weekly increase to AR$30/t. Offers for new soybeans of the 2018/19 campaign began to be made with delivery in a year at values around US$ 300/t, US$ 20/t below the price that the soybean contract averaged on previous week in Rofex for delivery this May.

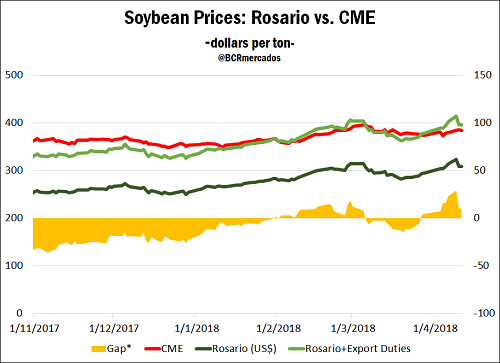

The domestic fall coincided with a rise in the CBOT, thus correcting part of the strong rise in the gap between both markets in the last month. For greater clarity, the attached graph shows the recent evolution of the nearest soybean futures in Chicago and Rosario (expressed in US dollars according to the "Banco Nación" purchasing exchange rate). A series corrected by the export duty in force for the local price is also exposed, in order to make it more comparable to the North American FAS value. The yellow area shows the differential between the corrected local price series and the Chicago price, and it can be seen that from a value of US $ (-15)/t on March 20, a positive gap of almost US$ 30/t was reached on April 9.

In Chicago, the bullish tendency was partly explained by the monthly supply and demand estimates report published by the USDA on Tuesday, reducing the estimates for the final US stocks as a result of an increased crushing demand. The greater processing is motivated by the strong meal prices, which boosted the industry's margins.On the other hand, the report aggressively cut the 2017/18 soybeans production estimates for Argentina, from 47 to 40 MT, foreseeing of course, lower crushing and less by-products exports compared to the previous month. Meanwhile, our intitution's Strategic Guide for Agriculture (GEA by it's name in spanish) also updated its production estimates for the week, again reducing the expected output to 37 million tons, the lowest volume of the last decade and 20 million tons below last season.

Regarding corn, the USDA raised the projection for US final stocks as a result of lower use for both feed and residual uses, compared to an offer that remained unchanged from last month. However, the rise in the level of projected inventories was lower than what the market expected, and the CBOT close on Thursday was in line with the previous week's values without further bullish or bearish fundamentals derived from the report.

With regard to the forecasts for our country, the USDA cut the figure of 2017/18 Argentine production from 36 to 33 million tons as a result of the losses in both yields and sowed area, forcing to subsequently cut the estimated exports volume to 24 million tons. GEA, meanwhile, kept its projection unchanged at 32 million tons.

In the Rosario's market, prices were mostly bullish and, on Thursday, the reference price was AR$ 3,770/t, rising AR$ 270/t in the week. There is a fluid commercialization of the cereal in the Rosario Board of Trade with several offers for future deliveries that arrive until July 2019.

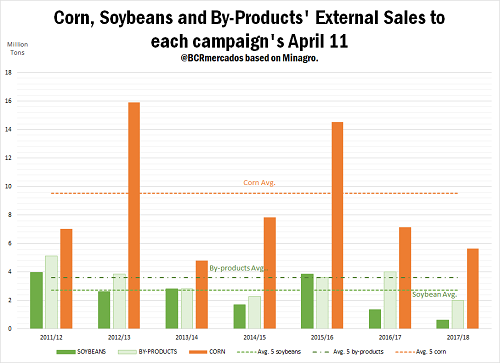

Faced with the productive uncertainty, the export market is very cautious in the sales statements, although it is believed that the latest changes in the registration regime (which allow export duties to be levied according to the effective date of shipment) could stimulate businesses. Today the external sales of both soybeans and corn are substantially below not only of those of the previous season, but also of the last 5 campaigns average, at the same point of the year. In fact, soybeans sworn external sales statements (DJVE by it's name in Spanish) were in April 11 about 611 thousand tons, which represents 45% of the previous season at the same height and only 25% of the average of the last 5 campaigns. In the case of the oilseed's by-products (meal and oil), 2 MT were sold, when last year's value doubled this figure. In the case of corn, the situation is less severe, with 5.6 MT, 79% of that of the previous season has been sold, and 56% of the last 5 campaigns average.

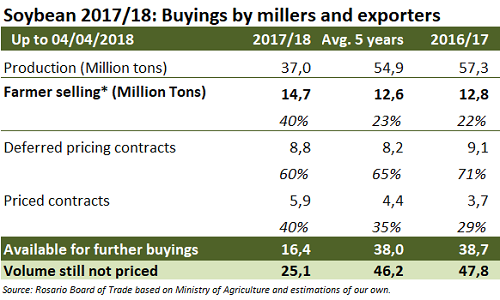

This does not mean that buyers are purchasing grain, but on the contrary, the origination of merchandise both in the local and international market is above the last campaigns. In addition to last week's purchase of soybeans from the US for a total of 240,000 t, as reported by the USDA, estimates of imports of soybeans from neighboring countries, mainly Paraguay, would far exceed initial expectations. Regarding the Argentine grains, according to information provided by the Minister of Agroindustry, to April 4, 40% of the estimated soybean production for the 2017/2018 season had already been purchased, practically twice the average of the last 5 campaigns. This ratio also doubles the 22% of the last season at the same height of the year. With a theoretical processing capacity of the oil industry of 66 million tons, it is clear that the grain provision for the manufacture of flour, oil, and other by-products with higher added value will be a difficulty to solve in the coming months.