Gran Rosario keeps the first place as the largest exporter region in 2017

PATRICIA BERGERO - JULIO CALZADA

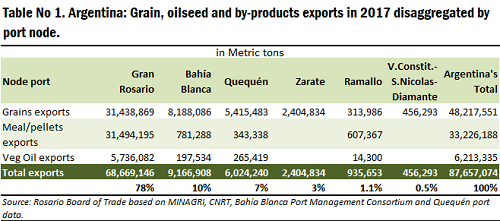

Argentine port nodes exported 87.6 Mt of grains, oilseed, meals and vegetable oils in 2017. The most important node was the Gran Rosario accounting 68.6 Mt. Bahia Blanca was second with almost 9 Mt and Quequén, third, with 6 Mt. The exports from the Gran Rosario and Zárate region increased while Bahía Blanca and Quequén had a fall in their volume compared with 2016. The port node with the highest growth was Zárate. The Gran Rosario share of total, grew to 78% in 2017 from 77% in 2016. Grains, oilseeds and by-products exports from different exports regions in 2017 Argentina exported about 87.6 million tons (Mt) of grains, oilseeds and by-products. The most important node was the Gran Rosario with 68.6 Mt. This is explained by the proximity of the oilseed crushing complex located alongside the Paraná River. Bahía Blanca port node was second with almost 9 Mt and Quequén, third, with 6 Mt. Table No 1 shows the total export shipments of grains, protein meals / pellets and vegetable oils from Argentina in 2017, disaggregated by product type and port node. Gran Rosario, the main export region in 2017, represented about 78% of the total national exports. The last figure includes goods from Paraguay and Bolivia that are carried with barges to this port node by the Paraná River to be later sent abroad with ocean vessels. It is an important figure: 4.5 million tons (Mt).

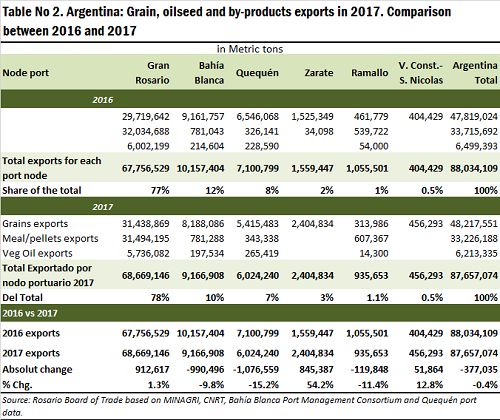

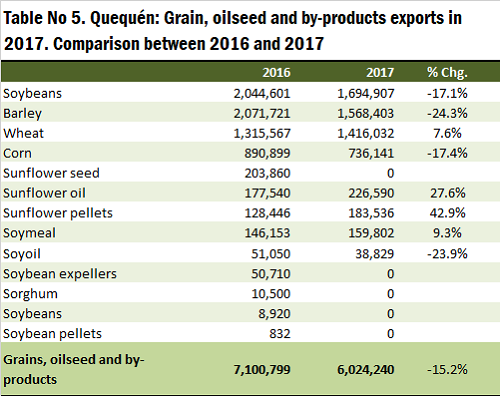

The port node of Bahía Blanca shipped 9.1 Mt (accounting 10 % of the total exports) raking this port in a second place. The third one was the port node of Quequén shipping 6 Mt. (around 7 % share of the total). And last but not least, the fourth place was for the port node of Zárate accounting 2.4 Mt. The node ports from Ramallo, Villa Constitución, San Nicolás and Diamante all together shipped 456,000 tons in 2017. Comparing 2016 and 2017 In 2017 Argentina exported less grains, oilseeds and by-products measured by volume. In 2017 the country exported 87.6 Mt while in 2016 the exports reached 88 Mt. At a disaggregated level, the ports nodes of Gran Rosario and Zarate exhibited an incensement of their exports volumes while Bahía Blanca and Quequén had a fall in their shipments.

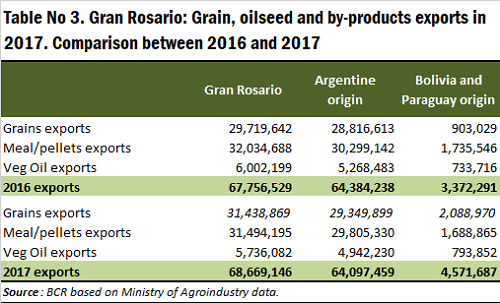

The decrease in 2017 was due to a fall in the exports volumes of meals and veg oils. This was despite of the increase in the exports volume of grains overall. In 2017 Argentina exhibited this figures: a) The soybean and sunflower crushing decreased in 2017 in Argentina due to a lower processing margin. In 2016 the soybeans crushing totaled 44.4 Mt while in 2017 decreased to 41.7 Mt. b) Soybean trading in the cash market decreased in 2017 compared with 2016. This turned out in larger stocks at the end of the 16/17 MY. The last figure is estimated at 13 Mt. We project that the lower production of soybeans in the 17/18 MY new crop due to dryness could make a cutback in the export figures. Despite this, the larger ending stocks could compensate the latter relieving the demand of the crushing and export sector. In 2017 more barges from neighbor countries arrived to the port of Gran Rosario As we said before, the operations at Gran Rosario port terminals grew last year. In 2017 it shipped close to 68.6 Mt, almost 912,000 tons more than in 2016 (67.7 Mt in 2016). In this way, its participation in the country total went from 77% in 2016 to 78% in 2017. The growth is explained by the fact that in 2017, more grains, oilseed and by-products arrived from Paraguay and Bolivia on barges for their transshipment to oceanic vessels. In 2016 about 3.3 Mt arrived from these countries (accounting corn, soybeans, meals and soybean oil barges). In 2017, these volumes expanded to4.5 Mt. This is 1.2 Mt more than in 2016. Thus, even though in 2017 there was a slight drop in shipments of Argentine origin from Gran Rosario (drop of 300,000 tons), the arrival of this greater Bolivian and Paraguayan stocks allowed the Gran Rosario to dispatch a total of 912,000 tons more than in 2016. All this can be seen in table No 3. It is important to keep in mind that we are not computing in these records the stocks that arrived from Paraguay under the temporary import regime.

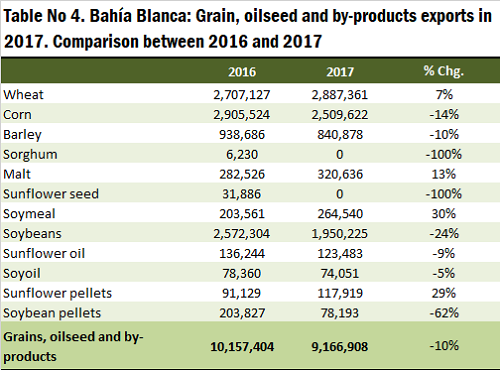

Less soybean and corn exports from Bahia Blanca and Quequén port nodes Around 1 MT was the decrease of grains, oilseed and by-products in the Bahia Blanca port node. In 2017 the exports shipments reached 9.1 Mt. The total decline came from a reduction of 622,000 tons of soybeans and 395,000 tons of corn. Barley and soymeal exports also reduced 97,000 and 125,000 respectively.

The port node of Quequén, as seen in the Table No 5, had a reduction from 7.1 Mt in 2016 to 6 Mt in 2017. This fall in about 1 Mt is due to less shipments of soybeans, corn, barley and sunflower. The only one that exhibited an increase was the wheat exports, rinsing 8 % compared to the last year figure. At the other hand, the figures from this region shows a bigger drop at processed agricultural goods such as sunflower oil, sunflower pellets and soymeal.

The factors that would explain this decrease in the shipments of 2017 with respect to 2016 in Bahía Blanca and Quequén would have been the following: a) 2016 was a year of very high loads because in December 2015, when the new government took office, there was stocks from the producers waiting to be sold. It was marketed during 2016 due to the reduction / elimination of export duties and the elimination of restrictions on external sales (mainly wheat and corn). For this reason, the records of export shipments for 2016 reached highs in all port nodes. b) As previously mentioned, there was less soybean and sunflower crushing in Argentina in 2017 compared to 2016, due to the low gross processing margins of the local industry. c) The soybean marketing by producers in the cash market was lower in 2017 compared to 2016, while waiting for better prices. This would have affected the reduction of export shipments last year. d) As reported by the Management Consortium of the Port of Bahía Blanca, there was a minor operation in some months of 2017 because of firm merges and repairs to the loading terminals and facilities. Anyway, during 2017, the movement of goods in the maritime area of the Management Consortium of the Port of Bahía Blanca reached 26,367,114 tons, being the 3rd highest volume in the last 25 years in record of the entity. Explanatory notes to understand the report: Gran Rosario: when we refer to the port node of the Gran Rosario we are adding the dispatches of the terminals classified in the category "South Zone of the Gran Rosario" plus those of the "North Zone of the Gran Rosario". The first category includes the ports located on the Paraná River to the south from Rosario to Arroyo Seco. Such is the case of Servicios Portuarios S.A. which operates Unit VI and VII, Cargill in Villa Gobernador Gálvez and Punta Alvear, Dreyfus in General Lagos and ADM Agro in Arroyo Seco. Those of the "North Zone of the Gran Rosario" are all located towards the north of the city of Rosario and include those located in San Lorenzo, Puerto General San Martín and Timbúes. They are Molinos (San Benito), Vicentín and ACA in the city of San Lorenzo; Bunge (Pampa and Dempa docks), ADM Agro (Transit), Cofco (former Nidera), Cargill, and Terminal 6 S.A. in Puerto General San Martín; Dreyfus, Cofco and Renova S.A., in Timbúes. Bahía Blanca: In the case of the Bahía Blanca Port, it includes the following port sub-nodes: Puerto Rosales, Puerto Belgrano Naval Base, Ing. White Port and Puerto Galván. The firms ADM Agro (Luis Piedrabuena and ADM docks), Bahía Blanca Terminal (sites 5-6, 7-8 and 9) and Cargill (with their own terminal) operate in Puerto Ing. White. In Puerto Galván they operate with agro-grains: Dreyfus and Oleaginosa Moreno OMHSA. Quequén: In relation to Quequén, most of the most well-known Argentine exporters operate there: Dreyfus, ACA, Cofco, CHS, Oleaginosa Moreno, Cargill, Bunge, ADM Agro, Amaggi, Noble, AFA, among others. Usually in the Port of Quequén there is a strong operative of Cargill and Oleaginosa Moreno companies in relation to the remission of meals / pellets and oils to the terminals of the node. Cargill has an oilseed crushing plant in Quequén with a theoretical milling with a capacity of 2000 tn / day, as well as Oleaginosa Moreno, whose crushing capacity in Quequén is 1,350 tn / day. This last plant usually crushes sunflower. Zárate: In the case of Zárate, the Lima terminal of Cofco plus Las Palmas and Guazú terminals are computed. In the case of Diamante, Entre Ríos, in 2017 it is observed in official records about 90 thousand tons of soybeans and wheat loaded by Cargill. Sources of information: In the specific case of the Bahía Blanca and Quequén port node, we have used the statistical information provided by the respective Management Consortiums. The rest of the data was taken from the reports of the Ministry of Agroindustry. Hence, there may be some differences with the statistics that emanate from the Ministry of Agroindustry of the Nation.