Good production prospects in the US and trade tensions with China push down the coarse grains

SOFÍA CORINA - EMILCE TERRÉ

The good humidity conditions in the United States pushed down soybean and corn prices in Chicago on the last week, in a market that was already stressed by the confrontations between the Chinese government and the US, regarding bilateral trade policy plans. In the fields of the United States, rains did not stop the planting of soybeans and the plans were completed. Indeed, according to the USDA crop report, there is a 12% of the soybean area transiting the flowering period, surpassing by 7 percentage points the average of the last 5 years. It highlights the high proportion of the crop in good and excellent conditions, which with 73% exceeds by 6 percentage points to the previous year. Similar panorama is repeated in corn. The cereal enters the flowering period, which, unlike soybean, represents the period of definition of yields. Good and excellent grades are at 77%, compared to 67% the year before the same date. Although the forecasts for the next 10 days point to temperatures that persist above historical averages, the wet pattern lowers the risk of stress for summer crops and provides a good productive scenario in the medium term. In the international market, tensions between the governments of China and the United States do not cease, which continues to hurt the FOB premiums of North American origin in relation to the provisions of Argentina and Brazil. These FOB or export prices represent the value at which each country offers to export the product, so the lower they are, the more competitive is the nation, assuming that the rest of the costs remain constant.

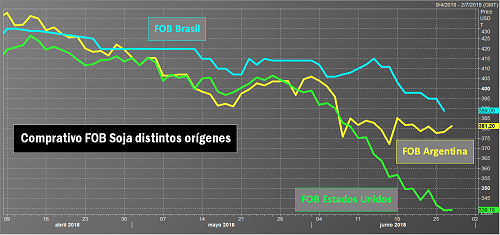

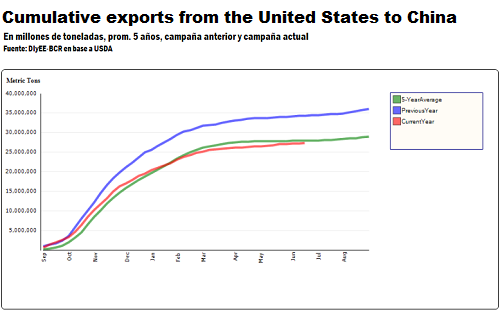

Faced with Chinese threat of imposing a 25% tariff on US imports, export prices in the United States fell sharply. It should be understood that lower demand will cause stocks to accumulate, depressing prices. Today, US exports of soybeans to China are already below both those dispatched at the same point of the previous year and the average of the last five years (see attached graph). In this context, the prospect of further damage to US soybean shipments to the Asian giant boosted sales by investment funds operating in the Chicago Market while widening the gap between the external price of the US bean in relation to Argentina and Brazil, as shown in the attached graph.

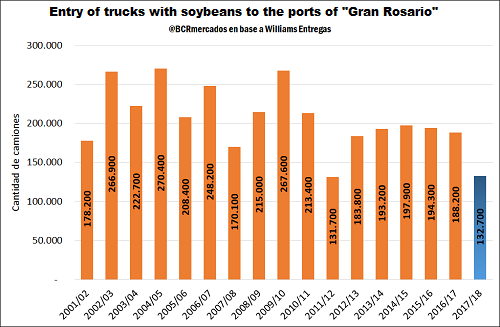

Regarding the movement of the grains, the lethargic rhythm of soybean income to the plants of the Rosario is evident. From the beginning of the new commercial year in the month of April until June 28, there was barely an entry of 132,700 trucks to the area, the second lowest in at least 17 years, only surpassing that of the year 2012.

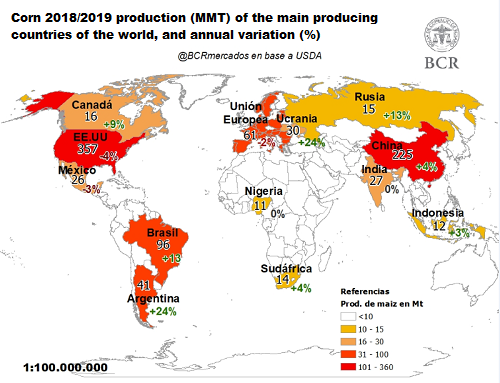

Prices in Rosario, meanwhile, advanced on Thursday to ARS 7,740 / t. This represents a weekly rise of 2%, although measured in hard currency there is a 1% drop in relation to the previous week's Thursday. Corn, meanwhile, recovered from the minimum of ARS 4,170 / t touching on Monday ARS 4,240, although it is still 1% below the previous Thursday. In dollars, the weekly drop accumulates 3%. In the international market, corn price prospects look somewhat more auspicious than those of soy. If the current forecasts of the US Department of Agriculture are met, the final global stock of corn could fall from 192.7 Mt to 154.7 Mt in the new 2018/19 season.