Good news for Argentine soybean meal: ocean freight is one of the lowest of the last 25 years

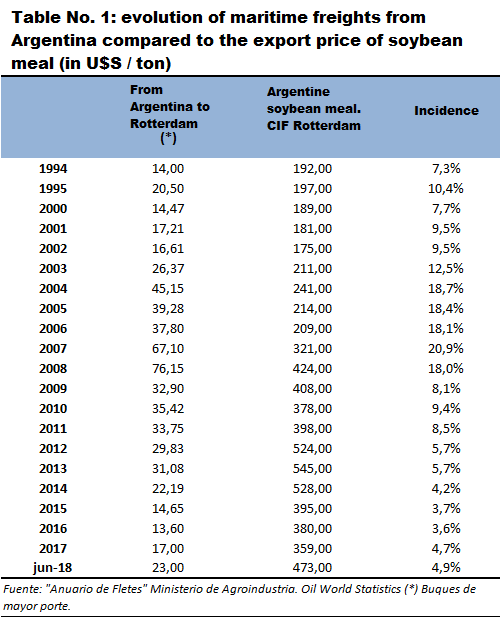

Indicator No. 1: The ocean freight to go from Argentina to Europe today is at one of the lowest levels of the last 25 years, if we relate it with the export price of our soybean meal. Currently, the freight represents 5% of the export price of the product (CIF Argentina-Rotterdam). In 2007, the "Maritime freight / export price of soybean meal" ratio was almost 21% in the months prior to the arrival of the global financial crisis.

It is important for a country such as Argentina, which takes prices in grains and by-products, to analyze the weight that maritime freight may have to transfer its production. We refer in this evaluation to the transport of Argentine soybean meal to the final buyers from all over the world. It is important to take into account that this is the Argentina´s most important asset for the generation of foreign currency in the trade balance. If we analyze the classification of exports by product, the "high protein soybean meal" was the main item in sales abroad in 2017 with 9 billion US$.

Argentina is located in an unfavorable geographical location compared to other producers such as the United States and Brazil in their sales to Europe and Asia. Maritime freight is a relevant issue because it impacts on the final price of the grains received by Argentine agricultural producers.

The analysis of the evolution of maritime freights in the last 20/25 years to transport soybean meal from Argentina to different parts of the world shows significant increases -in nominal terms-, mainly when we compare the values of the year 2000 with those of 2018 ( See table No. 1). However, deducting the effect of international inflation, freight rates from Argentina to Europe -in real terms- would barely be 10% higher today than in 2000. This phenomenon will be seen later.When we evaluate the weight of maritime freight with respect to the export price of meal (CIF), this indicator -for Argentina- is at one of the lowest levels of the last 25 years (Table N ° 1). Currently the freight represents 5% of the export price of the national soybean meal (CIF Argentina-Rotterdam), when in 1995 this value was 10%. In that year the price of soybean meal was US $ 197 / t, while it currently amounts to approximately US $ 470 / t. The price of the product grew more than the freights.

The year in which the weight of maritime freight on the value of the product reached its highest level was in 2007, with almost 21%. That year was the one that preceded the global financial crisis. Between 2007 and 2008 the costs of maritime transport registered a strong rise, before the international financial crisis came about due to the so-called "subprime credits". This crisis caused the fall of numerous financial entities, including the powerful investment bank "Lehman Brothers" in what was considered "the biggest bankruptcy in the history of the world economy" until the present. In the years prior to the crisis, the world economy grew with great acceleration. The great demand of bulk vessels and the lack of storage capacity led to ocean freights to exorbitant values. Just look at the table of this note to infer that in 2008 transporting a ton of soybean meal to Rotterdam from Argentina came to cost -on average- US $ 76 per ton, equivalent to multiplying by 5 what it used to cost in the year 1994.

After the international financial crisis, the cost of freight to Europe began to register a gradual fall until the year 2016, with a very low average cost of US $ 13 per ton. This was due, among other causes, to the drop in the GDP growth rate of the developed countries (especially the United States of America and European countries) since 2008, to the slowdown in the growth of the Chinese economy, fewer bulks to transport worldwide, greater offer of warehouse and the fall in the prices of the oil barrel. In that year, 2016, the lowest value of the indicator "Freight / export price of flour" for Argentina was registered, with 3.6%. Never before has the freight's weight been as low as in 2016. Likewise, the current 4.9% is a very favorable record for Argentine exports and their competitiveness.

It should be added that the average record of the year 2017 of this freight (Argentina-Rotterdam) according to information from the Argentine Ministry of Agroindustry was 17 U$S per ton, while currently (June 2018) amounts to 23 U$S / t. They are very reasonable values for our country.

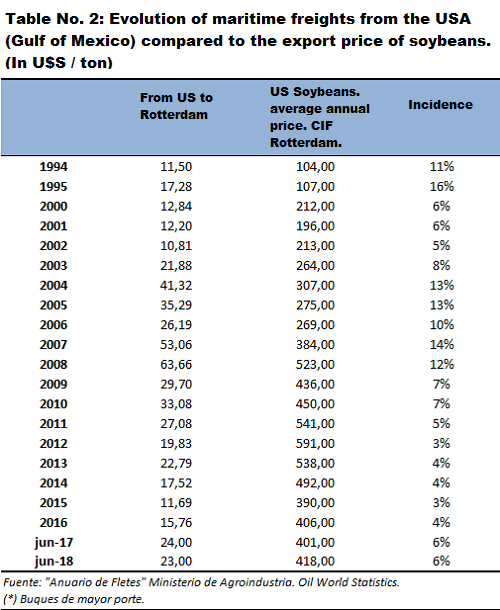

Indicator No. 2: The incidence of ocean freight to transport soybeans from the United States to Europe with respect to the export price of the oilseed has doubled in the last three years. It went from 3% in 2015 to 6% today.

Now let's look at what happens to one of Argentina's competitors in the world oilseeds market: the United States of America. We will specifically evaluate the exports of unprocessed beans. Transporting a ton of soybeans from the Mexican Gulf to Rotterdam currently has an average cost of 23 U$S / t, according to official information. The current weight of the freight on the CIF export price (Cost, insurance and freight from Rotterdam to USA) is 6%. With respect to 2015, this indicator has doubled in three years, since it was 3% in that year.

The United States is in a better competitive position today than it was almost 25 years ago, since the weight of the freight on the export value of merchandise today is 6%, when in 1994 it was 11%.

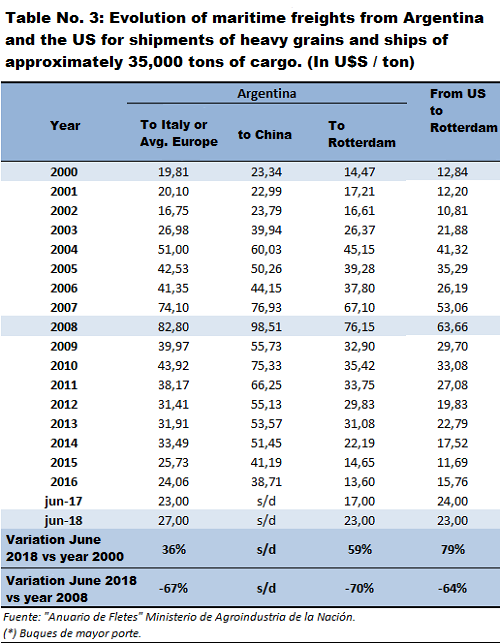

Indicator No. 3: In real terms, bulk ocean freights from Argentina to Europe barely grew by 10% in almost 20 years. It shows a growth in transport costs lower than in the United States. This increase -in real terms- is very moderate and favorable for the competitiveness of the Argentine granary complex.Table No. 3 compares the nominal evolution of freights in the period 2000-2018 of the following routes: a) Argentina-Italy freight, b) Argentina-China freight, c) Argentina-Rotterdam freight, and d) Mexican Gulf (USA) – Rotterdam freight. No conclusions can be drawn regarding the Argentina-China route due to lack of official information in 2017 and 2018.

On the Argentina - Rotterdam route in 2000, the average freight rate was 14.4 USD / t. Currently, as of June 2018, ocean freight amounts to US $ 23 / t. This implies an increase of 59% in the year-on-year comparison in nominal terms. However, if we proceed to take the effect of international inflation on freight rates (see table No. 4), the conclusions are different.

That is to say that what we must do is analyze the evolution of freight prices in real terms by comparing the values of the year 2000 with those of 2018. Remember that having paid US $ 1 for freight 18 years ago is not the same as pay $ 1 of freight now. There is a logical devaluation of the American currency as a result of inflation, that is, by the increase in the general level of prices. There is a loss of purchasing power of the US dollar due to inflation.

For this reason we proceeded to reformulate the average annual price of freight rates for 2018 to dollars of the year 2000. For this, we deflated that value (we take that monetary value "backwards") using the average annual consumer price index (CPI)) of the United States of America. This was the conventional measure of international inflation that we have adopted - in a simple way - in our study.

The US $ 23 / t which is the average price of the year 2018 freight from Argentina to Rotterdam, when deflating it and taking it to dollars of the year 2000, becomes US $ 15.86 / t. This implies that -in real terms- there has been a slight increase in the average value of this freight between 2000 and 2018 in the order of 9.6%, almost 10%. It is a very moderate increase in 18 years, which is very good for Argentina and its competitiveness in the granary business.The US freight, on the other hand, evolved worse than the Argentine one. The US $ 23 / t which is the average price of the year 2018 freight from the Mexican Gulf to Rotterdam, when deflated and took it to US $ of the year 2000, becomes US $ 15.86 / year 2000, similar figure to Argentina. This implies for the USA that -in real terms- the increase in the average value of the freight between 2000 and 2018 was 23.5%, almost double that in the Argentine freight. As can be seen, the increase in real terms of these freights has been more burdensome for the United States than for the Argentine Republic.

This phenomenon of moderate increases in the values of maritime bulk cargoes in recent years is an indicator of the low levels of growth of the world economy, the greater offer of vessels and the fall in oil prices, mainly. The WTI barrel was in May 2008 at 127 US $, falling in the same month of 2016 to 49 US $. Currently, as of May 31, 2018, it was trading at 67 US $ per barrel.