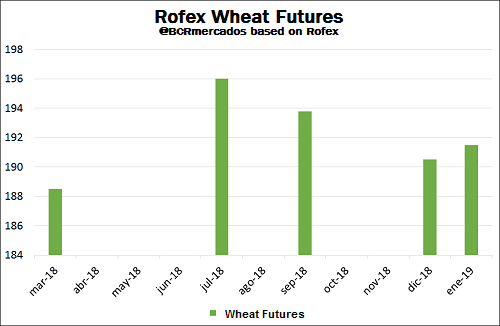

Domestic wheat prices continue to send signals to stimulate the cereal ' s sowing, with next year ' s crop prices above the current ones. Weather conditions are worrying for the planting of the cereal. In North America, the drought doesn ' t step back and the USDA reduced their export estimates. Last week, prices in the local market were relatively stable, with some small improvements. In fact, the reference prices which our institution publish on a daily basis suffered an increase of 1.8% on the week, to reach AR$ 3,770 / t on previous Thursday. Buyers are showing an increasing interest in the cereal, offering greater prices for the most distant deliveries. In fact, forward contracts to be delivered next year's January are valued in U$S 190 / t , while the current price is U$S 185 / t. The demand for present and future merchandise remains firm. To February 28, exporters had purchased 8.9 MMT of wheat, which perfectly covered the committed sales abroad, that amounted to 7.13 MMT. Moreover, the shipments' pace has been intense and the number of external sales is aligned with the shipments to set sail until the end of March. As it was mentioned, buyers are trying to stimulate the producers to plant more wheat in the coming months. Although there is a lot of remaining time to sow the cereal, the current context of drought and the scarcity of moisture reserves in soils in a large part of the productive areas, plus the 43% probability that the "La Niña" phenomenon will continue to affect the Argentine climate between March and May -according to information from the National Meteorological Service- creates concerns about the feasibility to maintain or expand the area destined for this cereal in Argentina. The need for wheat is perceived in the spread between the Rofex (Rosario futures exchange) wheat futures positions (see chart with values of different positions to March 7). The June 2018 contract exceeds by 7.5 dollars on March 2018, both positions of the current campaign. The seasonal pressure is observed in the price of the new crop, the January 2019 position, which falls to US $ 191.5 / t, which also exceeds the March 2018 price, which adjusted to US $ 188, 5 / t.

After the peak reached last week's Monday, March 5, the prices of March and May positions of CBOT soft wheat fell on the following journeys, to close on previous Thursday at 181.8 and 183.4 dollars per ton. This represented a fall of 2 and 3% In the Kansas hard red wheat, contracts Mar08 and May08 fell by 2% in both cases at the end of Thursday to close at 191 and 195.9 dollars per ton. As can be seen in the following graph, this cereal's prices have been raising threatened by dry conditions in the main producing areas of HRW. The drought continues to intensify and pastures and winter wheat are under heavy stress in the southern half of High Plains, particularly from Panhandle in northern Texas to the Kansas' southwest. To February 4, 78% of Oklahoma's winter wheat was under poor to very poor conditions, and under that same classification were 64% of the Texas wheat and 50% of the Kansas wheat. In the northern plains, winter wheat conditions are relatively better, but the truth is that the three southern states mentioned represent 57% of the area sown with this variety.

Spring wheat prices remain relatively stable as April approaches, the month in which the sowings begin, and the conditions in their main influence area are far from being as critical as those of winter wheat. On the other hand, the expectations of an increase in the surface of this variety for the 2018/2019 limit the price rises. Apart from the concerns about the future supply of US winter wheat, the prices achieved limits the country's competitiveness against other countries. Hence, supply and demand report that the USDA issued on previous Thursday, March 8, exports estimations were cut by 700 thousand tons to 25.2 MMT. It is enough to observe the USDA's weekly report on sales abroad. The US had external commitments (exports plus sales pending delivery) by 22.2 MMT, 12% less than the previous year and 83% of the estimated exportable wheat of the 2017/2018 campaign. The impossibility of materializing these exports becomes evident when comparing that ratio with that of last year, which had been 95%, or with the average of five campaigns, 94%.

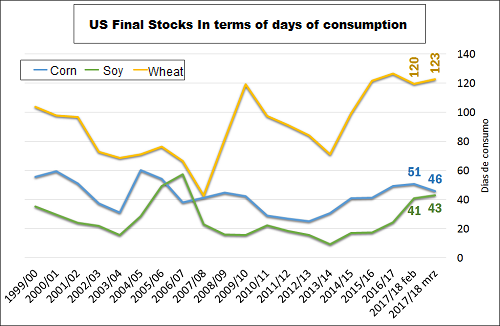

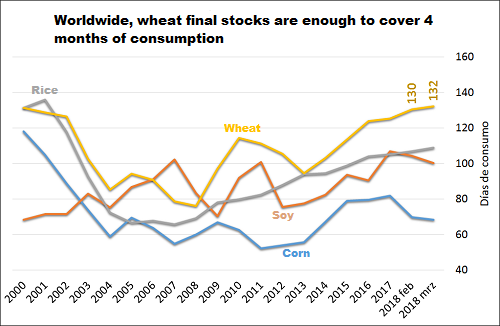

The reduction in the export caused an increase in the US 2017/2018 estimated final stocks, which would amount to 28.15 MMT. This was not predicted by the analysts who, prior to the USDA report, had calculated a figure of 27.62 MMT. However, at the end of the cycle the United States would have an inventory of wheat to cover 123 days of consumption, the highest since the mid-1980s. This is part of the same trend of a loose balance sheet of wheat worldwide, as can be seen in the attached graph. Within this balance sheet, it is worth highlighting the increase in the export figure of Russian wheat to 37.5 MMT, in line with private consultancies, mainly earning customers to the European Union.

It will be necessary to pay attention to the prices at which Russians will arrive at the Brazilian market, since they will compete with the Argentine cereal. Brazilians were importing high volumes of wheat in the first two months of the year: 666,000 t in January and 420,000 t in February. Quality problems, the rise in foreign prices and the strengthening of the Brazilian real against the dollar, among other things, made the grain importation very attractive, supplied in large part by Argentina. Meanwhile, CONAB (Brazilian National Supply Company) estimated last week that in 2018/2019 wheat imports will be at the same level as in the previous season: 6.8 Mt. The USDA did not come out yet with its estimate of 2018/19 but had a different figure for 2017/18 imports: 7.8 Mt.