Factors behind agricultural commodities´ prices

SOFÍA CORINA - FRANCO RAMSEYER - BLAS ROZADILLA - EMILCE TERRÉ

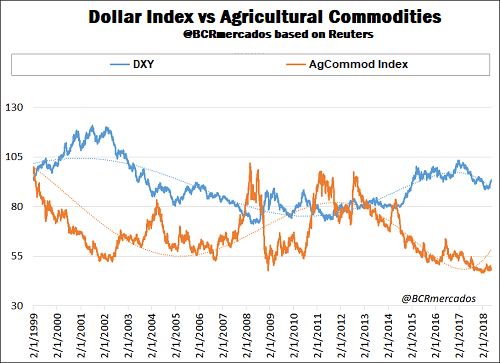

Weather Weather is one of the factors that most affect agricultural production. That is why anticipating forecasts is essential to identify prices trends. One of the main indicators of medium-term climate variation is the ENSO (El Niño Southern Oscilation), a phenomenon that combines changes in the ocean and the atmosphere and affects the weather in several regions of the world. ENSO events can have three distinct phases, "El Niño", "La Niña" or Neutral, if no significant variations are registered. When ocean temperatures are above normal in the equatorial Pacific, it would be before an "El Niño" year, which for Argentina implies more rainfall than the average in the summer (November, December, January); whereas a cooling may indicate that "La Niña" is coming, which allows to anticipate rainfall below the average in the same months. In the case of normal temperatures, it would be the Neutral phase. It is necessary to analyze not only this global phenomenon but also regional climate mechanisms that can moderate or exacerbate these effects. This crop year in Argentina was the classic example of this assertion. For this season, a weak "La Niña" had been anticipated, but as of the beginning of November, a regional factor called "blockade" took place. High pressure centers were installed in the Atlantic, in the Pacific and in high levels of the atmosphere, quite unusual, which intensified La Niña. This inhibited the precipitating mechanisms and generated what was considered a "perfect drought". The meteorological conditions will have a different impact depending on the phenological moment of the crop. For example, at the time of sowing, both drought and excess water will delay the work or increase the loss of seedlings. In the critical period, drought is the one that most affects grain formation. Finally, in the harvest season, excess water will delay the field work, exposing the crop to shattering and / or loss of quality. Any weather factor that prevents the performance of any field work and / or affects the grains performance, will be bullish for prices. US Dollar Another determinant that underlies the price of agricultural commodities is the value of the American currency. The relationship between these is inverse; that is, when the dollar appreciates with respect to the currencies of other countries, commodities´ prices tend to fall and when the dollar depreciates, they tend to rise. The mechanism is the following: given that commodities are valued in dollars almost everywhere in the world, the fact that dollar appreciates with respect to the currencies of other countries implies that commodities become relatively more expensive in those countries; consequently, the demand for agricultural products is reduced and so are their prices. The following graph illustrates this situation, by comparing the evolution of the DXY dollar index, which measures the value of the US dollar against other foreign currencies (euro, Japanese yen, pound sterling, Canadian dollar, Swedish krona and Swiss franc), with an index of agricultural commodities calculated by the Bloomberg agency. The negative correlation between both indicators can be clearly observed; that is, how the index of agricultural commodities decreases as the dollar index increases, and vice versa.

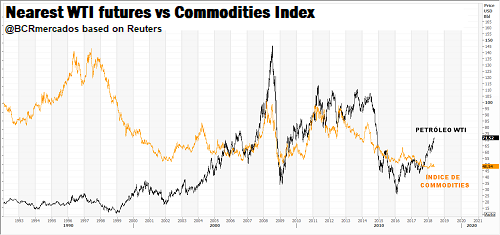

Oil Oil is an extremely important asset for the functioning of all the world's economies and, as such, its price variations are very easily transferred to almost all goods and services. This happens with a direct correlation; that is, when oil increases, other prices also do so, and when oil decreases, other prices fall. In particular, agricultural commodities are influenced by the price of crude oil through various channels. On the one hand, oil has a direct impact on production, distribution and processing costs, since it is used to start up the necessary machinery and equipment, both for planting and harvesting grains; to transport the merchandise in trucks and to carry out the processing of grains in the factories. Oil is also an input of many of the agrochemicals used in production, which increases the price of these products. On the other hand, there is a more indirect mechanism: the increases in the price of crude oil mean that part of its demand is transferred to biofuels, therefore, the demand for the commodities used in their production also increases, making its prices rise. The chart shows the evolution of the nearest WTI oil futures against an agricultural commodities index prepared by the Bloomberg agency. It is observed that the prices of both do not always vary in the same sense, but they do begin to present a greater correlation from the year 2006.

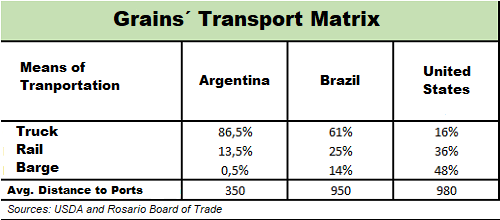

Regarding the value of crude oil, it has touched a relative minimum close to US $ 26 / barrel at the beginning of 2016, to start recovering from there. Currently, the WTI reference price is already over US $ 70 / barrel, in the face of a firmer agreement among the main producer countries members of the OPEC to adjust the offer in order to support prices of this asset which is crucial to their economies. On the other hand, the persistent geopolitical conflicts in the Middle East always boost the crude oil values. Transport Another determinant that has a significant impact on grain prices is freight. Beyond the direct relation of the freight price with the value of oil, the structure of a country's transport system and its infrastructure, the distances to travel to deliver the merchandise to destination (industry or port) and the distance of production to the sources of consumption, are important factors to determine the impact of freight on the price of grains. Taking as an example for the analysis the situation of Argentina, a net exporter of agricultural products and one of the main references in world food trade, one can notice that one of the main disadvantages that it has is the great distance that exists between our country and the regions where the global population is concentrated. The majority of the world's population lives in the northern hemisphere, and that is where the main grain importers are located. That is why our country is disadvantaged in relation to other exporters, which are less distant from the main markets. Within these costs not only is sea freight between the ports of origin and destination, but also the costs of transporting production from the field to the port play an important role. In this sense, Argentina has great advantages in relation to its competitors because the core production area of our country is physically very close to the ports from which grains are exported. This means that most of the grain production is located near Rosario's influence zone, from where 78/80% of the exports of grains, flours and oils are shipped. As we can see, in the core production area the farms are very close to ports and factories. However, one of the problems in our country is the transport of grains from the Argentine north to the ports of Rosario. There are distances between 600 and 1200 km, which usually must be traveled by truck, with very high transport costs. This is one of the reasons why the Rosario Board of Trade is promoting changes in the rail system, suggesting the implementation of the system known as "Open Access". In any case, Argentina has disadvantages in relation to its competitors in the export markets. In the following table, you can see a comparison of the transport matrix between the main exporters of soybeans (USA, Brazil and Argentina), where the large incidence of the truck in the local transport structure, the most expensive means, can be seen. In this sense, the United States is in better conditions than Argentina, since about 48% of the grains that go to ports to be exported, are transported in barges by river, this being the most economical means of transport.

Another important issue has to do with the possibility of events that hinder the mobility or dispatch of the products. Trade policies and geopolitical conflicts Decisions made by different countries in international relations, both in commercial and political matters, can generate changes in the global structures of markets and supply chains that have a strong impact on prices. Taxes or subsidies on exports, tariffs, non-tariff barriers, quotas on international trade, subsidies on production; these and many others are measures that affect prices. The policies will have their greatest impact on each country´s domestic prices, however, the greater their participation in international trade, the greater the influence that will be expressed on international prices. An example of this, which is seen in the current situation, is the trade dispute between China and the US, which began after the Trump administration imposed tariffs on imports of steel and aluminum from the Asian country. After this, Chinese government threatened to set tariffs on US products, including soybeans. These two countries are the main players in the international market of the oilseed. China is the world's largest importer and main buyer of US soybeans, while the US is the leading global exporter and supplier to the Chinese market. As a consequence of the conflict and in the face of a possible trade war, prices of soybean in Chicago fell sharply, affecting prices in the other countries markets, including Argentina.