The exports of Argentine soybean complex would account for about US$ 18,050 million in 2018/19

FEDERICO DI YENNO – EMILCE TERRÉ

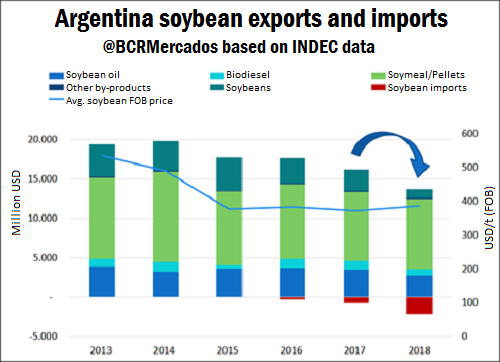

In recent years, the soybean complex in Argentina has been the country's main export sector. Soybean and by-products shipments – including pellets, expeller, oil, biodiesel, glycerin, lecithin, etc.- account for about 30% of the total Argentine export sales. In a good-yield cycle, the industry crushes more than 70% of soybean harvest in Argentina. Due to the severe drought that caused a 20-million-ton cut in soybean production in Argentina last cycle, the crushing and the exports of soymeal and soybean oil fell. As a result, the value of Argentine soybean complex exports fell by 15% -almost US$ 2,500 million- compared to the previous year in Jan-Nov period. Moreover, industrial plants in Argentina increased their soybean imports by 227% compared to the same period last year. Thus, net exports of the soybean complex fell by US$ 4,000 million in Jan-Nov 2018 period.

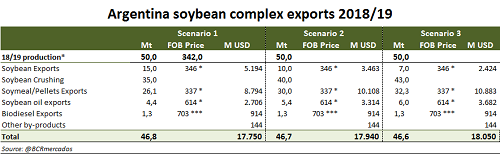

Argentine industrialization and exports will be closely related to the outcome of US-China trade dispute. Therefore, we present three different scenarios for the 2018/19 cycle assuming a soybean production of about 50 Mt. Scenario 1: the US-China trade war continues. China would increase Argentine soybean imports up to 15 Mt. Assuming a 35-million-ton crushing in 2018/19; soybean exports would reach US$ 17,750 million (FOB). Scenario 2: good harvest in Brazil, increasing soybean shipments from Brazil to China. Assuming 10-million-ton Argentine soybean exports, mainly to China, local industry could crush 40 Mt. Soybean exports would account for US$ 17,940 million (FOB). Scenario 3: optimum situation; local soybean crushing would reach 43 Mt and soybean exports, 7 Mt; prioritizing local added value over primary exports. In this scenario, exports would be similar to that in Scenario 2, although the volume of industrialized products exported would grow up to US$ 18,050 million.

In order to project the figure of the three scenarios, we assumed a conservative price ratio between soybean and byproducts of 88%, similar to the years 2016, 2017 and 2018. Based on these projections, then, Argentine soybean complex exports would account for between US$ 17,750 and US$ 18,050 million in 2018/19.