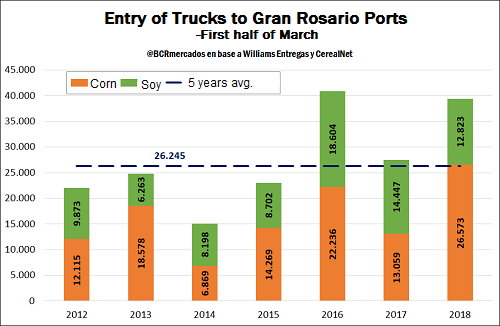

The bidders rush to deliver corn to take advantage of the premium that gives the present delivery in comparison to the deliveries for the next month, in a campaign in which the financial needs of the producing sector are exacerbated by the drought. Without certainty about the volume of Argentine soybeans and corn that will be produced this year, ensuring the merchandise's origination seems to be the safest bet. The relative tranquility in the rhythm of soybean and corn operations in the Physical Market of Grains of the Rosario Board of Trade is contrasted with a high volume of merchandise's deliveries, especially corn, in the Gran Rosario's port hubs. The producers need to make resources that allow them to face the serious consequences that the drought has on their cost equation, and take advantage of the price differential that still exists between the present price and the cereal's value in April. To March 15, the trucks for the unloading of corn and soybean in Gran Rosario port hubs accumulated in the month 39,396 units, compared to 27,506 in the first half of March 2017, increasing by 43% in comparison with last year and 50% above the average of the last five years, as can be seen in the attached graph. The dryness enables a rapid advance of the corn crop as there are several cases where losses due to drought will not allow to meet the level of expenditures that were scheduled, encouraging a greater volume of delivery.

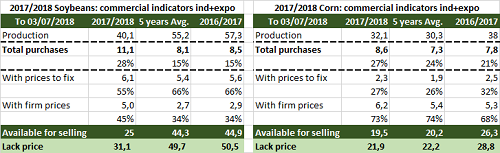

On the side of the buyer sector, a campaign with exacerbated production risk in the context of a demand that is still firm rewards the origination of the merchandise, and the volumes of purchases of the export and industrial sector by corn and soybeans reach the maximum since the year 2012/13 and 2011/12, respectively.

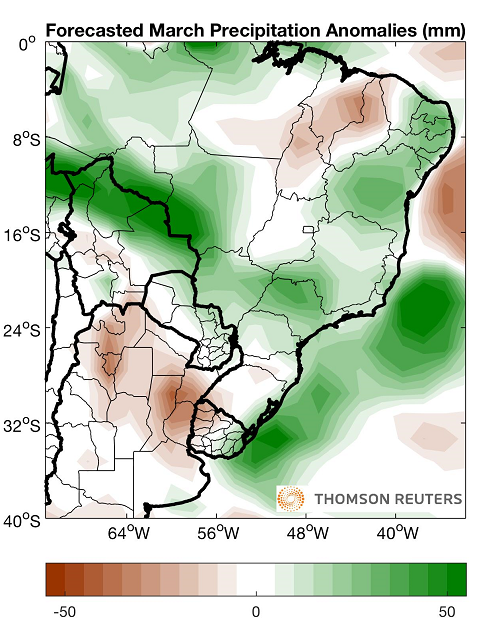

As can be seen in the attached tables, more than 11 million tons, or 28% of production, have been purchased by soy processors and exporters, close to doubling the average figures of the last five years. In the case of corn, the difference is smaller but the volume purchased still exceeds the average of the last five years, with the export sector explaining the difference. This greater proportion of purchases is not due to sales commitments, since both the export commitments of corn and soybean are below the average of the last five years. In the case of the cereal, there are committed sales of 3 million tons, when the 2016/17 season figure reached 3.4 Mt and the average of 5 years is 7 Mt. In the case of the soybean complex (bean and by-products) foreign sales were committed for less than 400,000 tons, below both the 2.2 Mt of the previous year and the 1.4 Mt average of the last five seasons. It is normal that, in a context of great uncertainty regarding the volume of grain that will be available and when it will reach the market, the demand choses to secure the possession of merchandise but not to compromise too much with its dispatch, since potential breaches in foreign trade entail burdensome losses. While this week our institution's Strategic Guide for Agriculture cuts its estimates of soybean and corn production to 40Mt and 32Mt, respectively, the market doubts whether this is the floor, especially in the case of the cereal that has yet to finish defining the yield for the late-plantations. In terms of prices, the tendency to combine values for the old and new harvests in the case of soybeans is still in force, while corn undergoes seasonal pressure at the height of the threshers' progress. Thus, our institution's reference price fell 7% weekly for the cereal to Thursday, when the price was established at AR$ 3,380 / t or US $ 167 / t. According to the MATBA reference, prices for delivery in April already fall to US $ 176.50 / t, and US $ 175 / t in July, with a weekly loss of 2.5% for both cases. In this case, the premium between the present and the April contracts is around US $ 10 / t, explaining the existing incentive for present deliveries mentioned above. In soybean, our institution's reference price on Thursday was AR$ 5,900 / or US $ 291.5 / t according to the "Banco Nación" exchange rate, with a weekly decrease of 3%. In ROFEX, futures that expire in May adjusted Thursday to US $ 293.1 / t, with a weekly drop of 2%. In the CBOT, soybeans fell 2.2% on last week to US $ 382.42 / t for delivery in May, pressured mainly by the strong competition that Brazil is presenting to the United States in the international market. Some consultancies estimate a record soybean production of 117 million tons, surpassing 114 million tons last season. At the same time, Reuters reported Brazilian exports by almost half a million tons a day in the first week of March based on data from the Brazilian Ministry of Foreign Trade, 25% more than the same month last year. Regarding corn futures in this market, the May 2018 contract reached the highest price since July 2017 on Thursday 8, at US $ 154.92 / t. Although last week the figure fell to US $ 152.26 / t, it still remained very close to the maximum previously achieved. The main support for the American cereal is the firm export demand in the context of the drought that affects Argentina, a US competitor. Looking ahead, the main focus of uncertainty is when the drought in Argentina will be finished, as the field prays for water. However, the forecasts are not so encouraging for the next two weeks. Indeed, a report published in the Agricultural Weather Dashboard of the agency Thomson Reuters reveals that for the rest of the month of March expected precipitations are inferior to the normal ones, with high probabilities that the dry conditions persist, as it can be observed in the map following this paragraph. The situation is extremely critical, especially in a campaign in which more than half of the cereal area is covered by late corn that still has much to lose under the current circumstances.