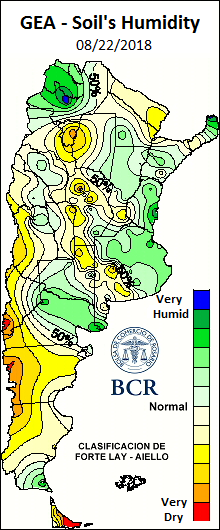

In the local market, the price of soybeans responded to the external drop by falling 4% during the week (from August 16 to August 23) to US$ 254/t (Rosario Board of Trade reference price). While corn managed to recover by the end of week after its setback that started on Tuesday, it closed at US$ 151.4/t on Thursday the 23rd. The market continues to be rather lethargic in the case of soybean, as there is record of open offers only in the spot and September delivery, still not trading the new crop. In opposition to soybean futures, there are currently in the market corn contracts with delivery in July 2019. In the case of the cereal, the market is now suffering the consequences of the summer drought as less than 90,000 trucks arrived in the Rosario Hub's ports between June and August. In the same quarter last year, around 125,000 trucks arrived in Rosario cluster, almost 40% more. However, as corn prices fulfil the farmer's expectations, there is an increase in this year's sowed area. Low temperatures and frosts are delaying the start of 2018/19 corn crop. This may cause further labor delays since corn requires a ground temperature of approximately 12 ° C to emerge properly. In addition to low temperatures, ground moisture is also not enough to start planting corn. In the core region the planting date of the first corn crop is around September 15, currently a minimum of 20 mm of water is required to reestablish the surface moisture. Although fortunately there are good water reserves in the ground of this region, the demand for water increases significantly in the central region, as shown in the attached map. This last area requires an accumulated of 60-80 mm to restore moisture for planting.

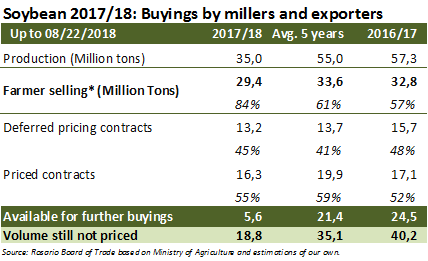

As to soybeans, the combination of the fall of CBOT prices and the lower ability to pay of the industry and export sector had a negative impact on local prices. Argentine The relative lower fluidity of the "star product" is going through a low activity phase due to its lower availability because of the drought that affected the crop last summer, plus, the lower export activity of the soybean complex, the main supplier of genuine currency of the country. The lower availability of soybeans is reflected on the purchases of the industry and the export sector that already add 29 MT, 83% of the estimated production. Purchases by this time last season were only 53% of the production. Subtracting the estimated consumption as seed and others to the tonnage harvested, the soybean available by this time of the year barely reaches 6 MT, while last year there were still 25 MT. Although the initial stock should still be added to this volume, it seems clear that this season's balance will be tighter than previous crops average.

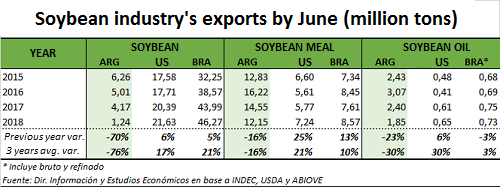

In order to see the weakening of the export activity, the following table shows soybeans, soymeal and soybean oil exports by June originated in the three main world suppliers (Argentina, United States and Brazil).

The US and Brazil experienced a year-on-year increase in their exports of both soybeans and by-products, and more importantly, they exceeded the average of the last three seasons (being Brazilian oil the only exception to this, as dispatches exceeded last three season average, but the volume remains below the one of the previous crop). Meanwhile in Argentina there is a strong decrease in shipments. As for soybeans, accumulated exports between January and June are 70% below the first half of 2017 and 76% below the average of the last three seasons. In the case of soymeal, a 16% less was shipped if compared to both the last crop and the last three seasons average, while oil shipments were 23% lower than in the first half of 2017 and 30% lower than the average of the previous three seasons. Observing current crop's committed sales, the lower level of activity is evident. If we convert soymeal and oil committed sales to its equivalent in grains, we will find out that they represent 18.6 MT, far below last crop's mark of 27.3 MT and last 5 seasons average of 28.4 MT.

Despite the greater strength shown by next crop committed sales, we must bear in mind that the changes recently introduced by the government that remove retention tax reductions for by-products exports may favor soybeans over its industrial products.