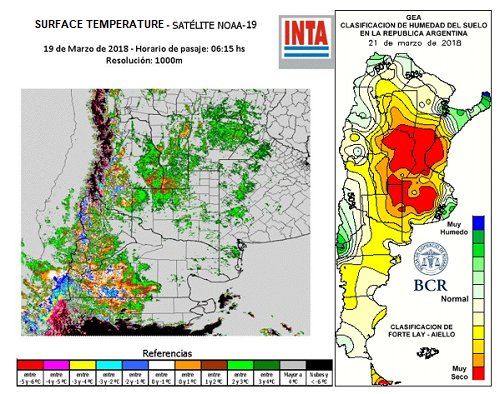

In the Argentine soils, the harvesters advance configuring one of the worst productive scenarios in recent years. The first results of the soy harvest in the core region show a very high disparity of situations, from 2 to 5 tons per hectare depending on the influence of the water table. The zonal averages for the early soybeans plots are close to 3 ton/ha. Meanwhile, crops planted after wheat were the most punished by dry weather. The hope of partially offsetting the yields by higher weight faded last week. Not only rain forecasts failed, but also, the minimum temperatures were below normal parameters for this time of year. On the INTA map (left) it can be seen that the temperature was between 2-3 ° C in a large area of the east of Córdoba province. The drought, as a constant background, is shown on the map on the right.

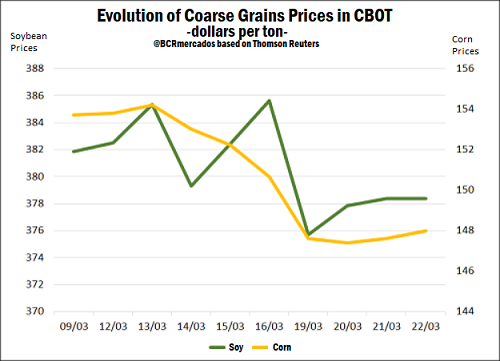

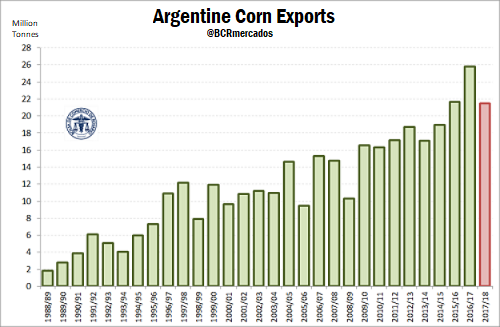

The low temperatures cut the grain filling process, which along with the scarcity of water, not only soybean crop will form a small amount of grains, but also they will be small and many of them green. Green soybean seeds have a high impact on marketing. This color is because the plant dies prematurely and with it the enzymes responsible for the degradation of chlorophyll. This pigment in the beans can be a reason for punishment in the harvest price since in the industrialization, the chlorophyll would be incorporated to the oil, taking the risk that the oil will be rejected in the international market if the tolerance parameters are exceeded. As regards corn, the yields of plots planted early are located within the range of 8,5 to 10 tons, these values being better than expected. However, corn planted in December (late corn) is seriously damaged by dry weather. Many hectares will be destined for animal consumption, and others, with the blessing of the water table, will be harvested. In the Chicago Board of Trade, meanwhile, soybean closed at US $ 378.37 / t, 1.06% below the previous Thursday, and corn at US $ 147.99 / t, with a weekly drop of 2,78%. This fall was motivated, fundamentally, by the sales of contracts by investment funds and the threat of a commercial war between the United States and China.

Regarding the first point, according to Reuters, the speculative funds sold in CME Group 25,000 net contracts of corn and 16,000 of soybean only on Monday, representing the largest daily net sale in corn since November and the second largest in soybeans since last year's July. Behind these sales are both technical factors and the expectation of an aggressive policy of interest rates by the Federal Reserve of the United States. On the other hand, it is feared that the tariffs imposed by the US government, on steel and aluminum, which greatly harm China as the main trading partner, result in a bid between the two powers that hit by lifting American shipments of grain to China. China is the main importer of soybeans worldwide and of beans from the US, according to the Department of Agriculture of this country (USDA), in the 16/17 season China acquired a record of 93.5 million tons of soybean by international trade, 36.15 Mt were American. This amount represents 62.2% of the total export of soybeans by the US. The USDA aggregate in China reported this week that it expects this upward trend to continue and boost soybean imports to reach 97 Mt in the current season, and reach 100 Mt on 18/19. The increase in income, urbanization and modernization of the domestic sectors of food and livestock are the factors behind the expected growth in Chinese consumption of oilseed products. Considering this, the possible commercial war could reconfigure the structure of the commercial framework of soy.