Available wheat has appreciated in relation to the next harvest

FRANCO RAMSEYER - EMILCE TERRÉ

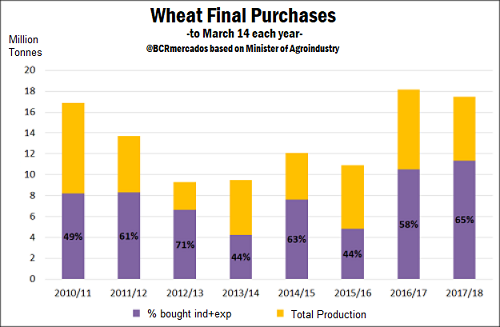

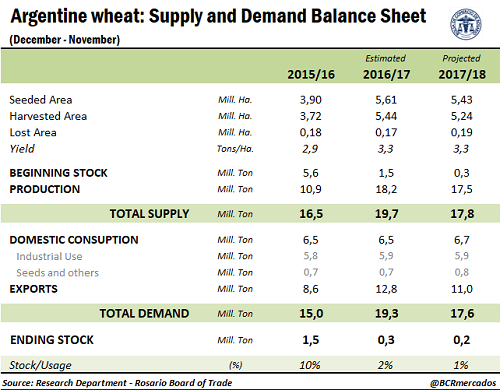

The 2017/18 season started with the lowest wheat stock in almost 15 years, barely 1.5 million tons, while excess water damaged the planting intentions. Although the yields were relatively good, the 17.5 million tonnes production was lower than the 18.2 Mt of the previous season, and demand is not resigned to absorb less grain. It is important to note that the beginning of the campaign with the lowest stocks in the last fifteen years was due to the effect of various government measures that favorably impacted on wheat exports in the last two years, such as the elimination of export duties and restrictions on external sales (ROEs). Domestic consumption is very stable, and its evolution is mainly linked to the rise in the long-term population level. Export purchases, on the other hand, do not give up and are at record highs. Regarding of purchases from the export sector, according to information to March 14, these accumulate 9.2 million tons, the highest record for this height of the year. With average purchases of the industrial sector around 2.2 million, the final consumers of wheat (industrial or exporters) account for 11.4 million tons, or 65% of the estimated production, the highest percentage of the last five years.

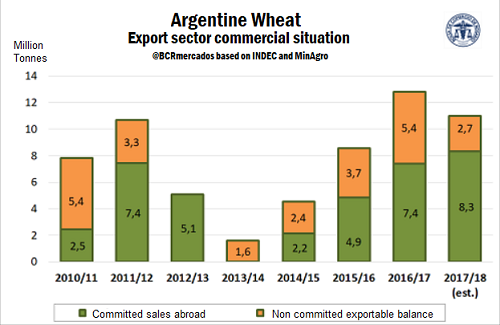

On the side of external sales, to date are recorded sworn statements of sales abroad for a total of 8.3 million tons of wheat 2017/18, the highest tonnage in the records for this time of year. With an estimate of total shipments for the new campaign of 11 million tons, this means that 76% of the exportable merchandise is already committed, leaving only 24% of it free to be sold in the future. This percentage is very close to the average of recent years, and represents just 2.7 million tons.

As for what was actually exported, in the three months for which there are official records since the beginning of the new campaign, the volume of grain shipped exceeds the already high records of the previous year. In February, grain exports totaled 1.7 million tons according to INDEC (National institute of statistics and censuses), thus, in the first quarter of the 2017/18 commercial cycle, more than 6 million tons were shipped, or 72% of what is sold. Among the destinations, although Brazil continues to lead the ranking with a participation of 25%, in the top 10 appear countries as distant as Algeria, Indonesia, Thailand, Bangladesh or Kenya.

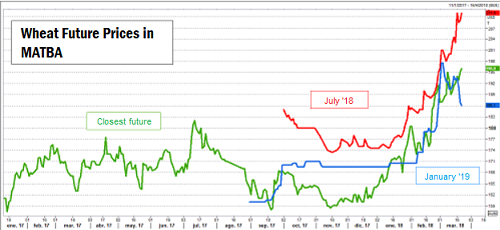

The high volume of export commitments supported the prices of wheat both available and futures for delivery in July. Regarding the first, the Rosario Board of Trade's reference price for Thursday was AR $ 3,990 / t, 5% over the previous week, while in MATBA (Buenos Aires Futures Market) the contracts with expiration in July closed at US $ 211 / t, rising almost US $ 10 / t in the week. The strong demand we are experiencing for Argentine wheat does not allow for inventories to recover, and even a slight adjustment is expected compared to last season. Indeed, the inventory that would remain for the next commercial campaign is almost nil, putting more pressure on the sowing intentions that are foreseen for next winter, and that is where rainfall forecasts become more important in the medium term.

Indeed, after a dry and hot summer, the moisture profile of the soil does not have the necessary conditions to ensure a good seed implantation. The price of wheat for delivery between December and January (coinciding with the next harvest season), have been moving alligned with news that point to higher or lower accumulated rains for the autumn/winter in Argentina. As early as mid-March, the NOAA and the Department of Meteorology of the Government of Australia agreed that the "La Niña" phenomenon is lagging behind, giving rise to the development of neutral conditions between the months of March and May. It should be noted, however, that this does not mean that there will be normal rainfall and temperatures, but indicates that it is unlikely that the climate will remain in extreme conditions for prolonged periods: that is, it is not expected to be neither very dry nor very humid, neither very warm nor very cold. This week, unfortunately, the diagnosis of Carlos Di Bella, director of the Institute of Climate and Water of INTA, added that in June the rainy season would return below normal, a pattern that would continue throughout the winter. Fewer arguments pointing to a continuation of the dought in the next two to three months and the external decline against the rains that have occurred in recent days in the North American Plains ended up pushing the price of wheat futures for the next campaign 2018/19. These fortunate water falls in North America, added to the good moisture reserves in the countries of the Black Sea region, which lead the rankings of wheat exports, made the prices of the nearest futures in Chicago fell by 8%. % or 14 dollars between March 14 and 22. In MATBA, the January 2019 future for unloading in Rosario closed on Thursday at US $ 187 / t, with a weekly drop of US $ 6 per ton.