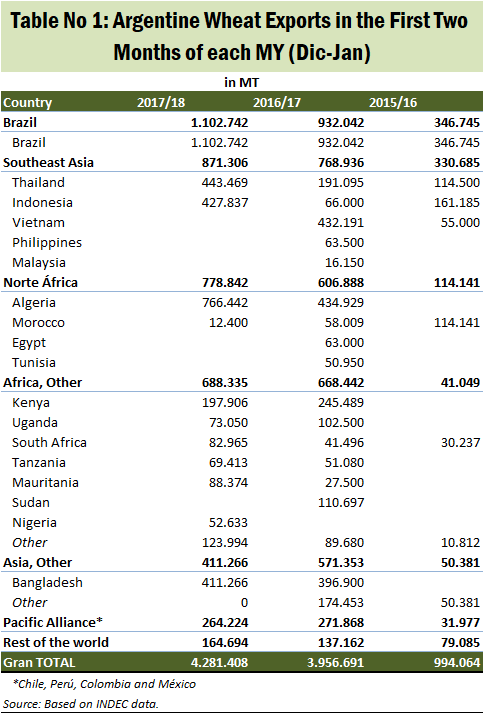

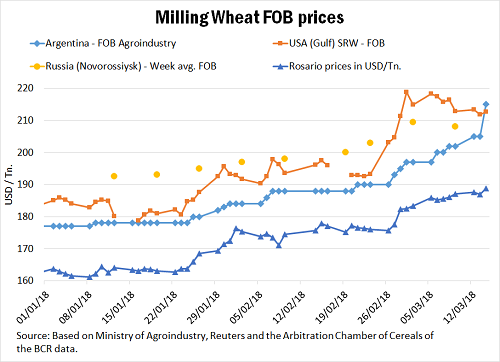

Argentine wheat FOB prices increased 15 USD/MT in the last week due to a stronger demand from Brazil, Algeria and Southeast Asia countries. Thus, the increasing prices at the foreign markets helped to improve the local wheat prices. Therefore, the increasing demand along with the uncertain in the U.S supply boosted the 17/18 MY local wheat prices. According to INDEC data, in December 2017 and January 2018 combined, Argentina's wheat export volume reached 4.28 million tons (Mt) rising 8 percent from the same previous period (This is more than 300,000 tons). This increase is mainly due to larger exports to North Africa, Brazil and Southeast Asia rising 28, 18 and 13 percent respectively compared to the same period of the last 16/17 marketing year.

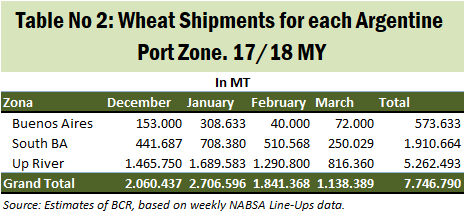

The increasing demand for argentine wheat is seen also at the exports sales and wheat purchases by the export sector. According to the Ministry of Agroindustry data, exports sales for 17/18 MY reached 7.6 Mt as March 7 whilst at the same date of the last MY, this figure was 7 Mt. Hence, wheat purchases by the export sector reached at the same date 8.9 Mt as reported from the same source. This amount rose 600,000 tons compared with the same period of the last 16/17 MY. According to BCR estimates, 16/17 wheat ending stocks closed on historic lows in record. This added to the lower harvest in the 17/18 MY links to increasing local prices while the external demand remains active showing up from Asia and Africa. This data correspond with the latest reports of other think-tanks like the International Grains Council and the previous WASDE reports. The uncertainty about the weather forecast in the U.S. also helps to the rally in prices at the international markets, as mentioned in the last newsletter. Another data that helps to understand the currently larger exports are the lower ending wheat stocks in Brazil combined with higher needs for stocks at the milling sector to produce flour at April. Looking out at very estimates shipments figures based on NABSA Line-ups, between December 1, 2017 and March 17, 2018 Argentina's ports would have shipped 7.74 Mt of wheat being a very close number to the exports sales reported by the Ministry of Agroindustry. (Note: Exports departures may differ from the various sources: INDEC exports, NASBA Line-ups and exports sales from the Ministry of Agroindustry.)

Breaking down the latter data, its results that 68 percent of the shipments departed from the Up-river port terminals in the 17/18 marketing year. Analyzing at a country level, a similar share of the total, as seen in the INDEC data, remains for the shipments figures. Brazil dominates 24.61 pct. of the total, Algeria 17.7 pct. while Indonesia, Thailand, Bangladesh and Vietnam grouped by its nearness received 26.71 pct. of the shipments. Egypt did not buy Argentine wheat at all. This is because most of the wheat comes from cheaper and closer wheat from the Black Sea Region (most of them comes from Russia).

In view of the aforementioned factors, the official wheat FOB prices published by the Ministry of Agriculture increased from Wednesday, March 7, 15 USD / Tn at the external markets. This rising in prices was evident both in the price of local wheat and in other markets around the world. This gives us the guideline that despite the annual increases that continue to be recorded in production in the world, the demand for cereal remains firm hand in hand with the growth of emerging countries as is the case of Asia and Africa. Following the movement of the price of wheat in USD, as published by the Arbitration Chamber of Cereals of the BCR, it would be reaching highs at the end of August 2014. The price in pesos of the same oscillated in the last week between 3,700 and $ 3,770 / Tn, reaching its maximum value on Wednesday, at $ 3,800 / Tn. Regarding the forwards to Thursday, the deliveries for April and May were offered 187 and 189 dollars per ton while the contracts with July delivery were offered at US $ 192 / t. These positions showed improvements of up to 2 USD / Tn. Finally, the new crop delivery of January 2019 continues with a value of US $ 190 / t.