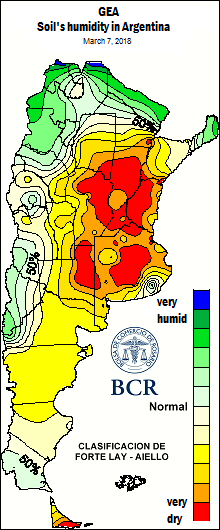

March rains are similar to February exhibiting a rather large deficit. The beginning of the new local harvest and the Chicago prices downturn drove down the prices for the local soybean. At the other market, the needs of the export sector allowed the corn to get around the rock and stand firm on its upward path. The days pass and the water reserve maps become increasingly red. There is no longer talks about yield losses, but directly about planted area losses. The crops that will contribute to this category of unharvested area are those planted in December, both the "late-planting" soybeans and corn.

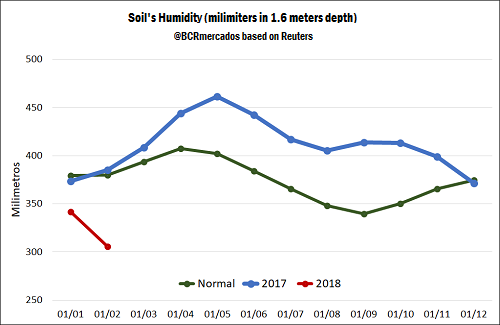

February was fateful in terms of rainfall. In the province of Santa Fe, it rained an average of 20 mm. March, so far, has not reversed the dry outlook and the current situation of soil reserves is worse than in the last two droughts (2008 / 09-2011 / 12). As shown by the evolution chart of water reserves from 0 to 1.6 m depth, the year 2018 began with a lower water load in the soil (300-340 mm) compared to the historical averages (375 mm).

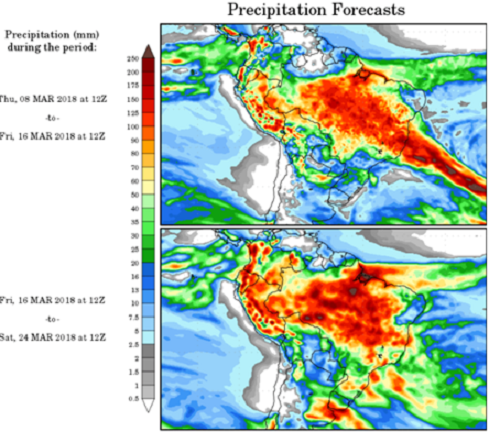

However, the 15-day forecasts indicate significant rainfall of the order of 60 to 100 mm. These rains are late to reverse the damage, they can improve the grain weight of some second-rate soybeans but there will be no significant increases in yield. On the other hand, they provide relief to the soil, which profile is totally dry and needs to recover for the new season.

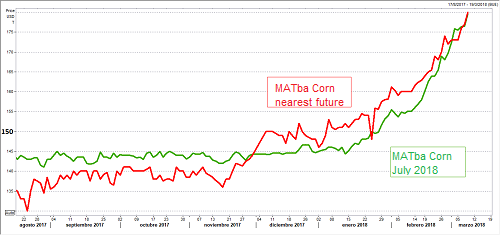

Increasing the discouragement of the productive sector, in the week the splicing of harvests pushed down the prices of soybean although the needs of the export sector allowed the maize to get around the rock and maintain its upward trend. Regarding the oilseed, although formally the new 2017/18 soybean marketing campaign in Argentina begins on April 1, harvesters timidly begin to advance on the fields and the Rosario Board of Trade is reacting to the crop splicing, while that the evolution of prices in Chicago added pressure to the downside. The coupling of negotiated prices was evident in MatBA, where the nearest futures and the contract for May delivery adjusted on Thursday to US $ 302 / t and US $ 302.5 / t falling by 3% and 2% in the week, respectively. Just ten days ago, the gap between both contracts was almost US $ 10 / ton. Going forward, this retraction is limited to a seasonal decline associated with the harvest since, although the price of the future November adjusted the week to US $ 316.5 / t, 2% less than the previous Thursday, the implicit contract rate it is around 30% in pesos, a level much higher than the expected inflation for the next 8 months, referring to the potential profitability of the position. In the Rosario Board of Trade, the reference prices fell to AR$ 6,100 / t for Thursday's operations, down -3% from the previous week. In the CBOT, meanwhile, the nearest future fell by -0.5% to US $ 387 in the week, pushed by the bearish trend of the Monthly Supply and Demand Estimates Report of the US Department of Agriculture (USDA), which ended with the bullish gap in the bean in recent weeks. In the latter, the agency increased the forecast of US stocks caused by lower exports, leaving as a balance a final stock for the American campaign 2017/18 of 15.1 million tons, above the 14.5 that was on average expected by operators. The fall, however, was limited by the aggressive cut of 7 million tons to the projection of Argentine production, which was 47 million tons. For Brazil, the estimated output of 113 million tons is one million higher than last month but it is lower than what the market discounted. Contrary to soybean, corn prices in the local market remained firm in view of the need of the export sector to comply with a high shipping schedule. The reference local price was at AR$ 3,620 / t, 3% above the previous week. Only in what remains of the month of March, the commitments of shipments of the port terminals of the Great Rosario surpass the million tons, 25% over the programmed to the same height of the previous year. With production prospects that adjust week by week and a demand that remains firm, the deferred offers for the cereal repeated the bullish pattern. The nearest corn future negotiated at MatBA closed the week at US $ 180 / t, 4% higher than last Thursday. The contract with expiration in July, associated with the suffered second crop, closed on Thursday at US $ 179.6 / t. Thus, the gap that started January at almost 6 dollars a ton today does not reach 50 cents. It is clear that market prospects have changed for late cereal.