Argentina increases soybean and corn shipments in November

SOFÍA CORINA - DESIRÉ SIGAUDO - EMILCE TERRÉ

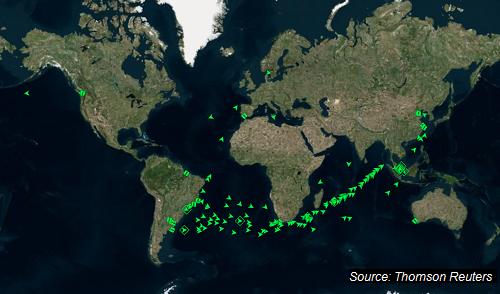

Soybean shipments from South America had a strong impulse amid U.S.-China commercial war. The following map shows that vessels carrying soybeans currently leave South American ports (mainly Brazilian ports) towards Asian countries (especially China). This scenario is completely atypical for this time of the year, as American farmers complete their harvest in November and US exports usually have a seasonal peak this month. Accumulated U.S. soybeans export sales to China are only 339,000 tons, while in the previous cycle they reached almost 15 million tons. Moreover, it should be bear in mind that the present season might involve a record harvest in the U.S.

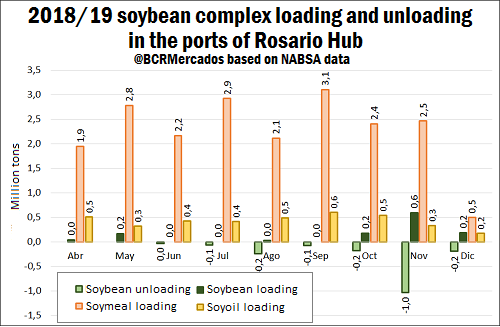

According to NABSA, almost 600,000 tons of soybean will be shipped from the Rosario Hub's ports on November, more than Argentinian's seasonal peak in March. At the same time, the program for soybean ships arrivals is particularly busy this month, exceeding one million tons. Moreover, almost 2.5 Mt of soymeal and 33,500 tons of soybean oil would be shipped.

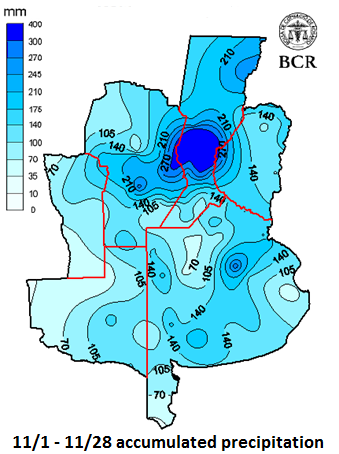

The chances for Argentina to start exporting soymeal to China, however, seems remote as there are many other better-positioned countries competing for this market. India, for instance, offer lower freight costs in addition to the greater competitiveness thanks to a weaken rupee. At the same time, Ukraine sharply increased its sales of sunflower meal to China that may substitute soymeal. As for the local market, the strong volatility of the exchange rate in Argentina last week impacted on soybean spot price while new soybean crop price is being influenced by the current stumbles suffered by the crops in the core region. Thus, Rosario Board of Trade's reference price on Thursday was US$ 245.2/t, and MATba May future had a US$ 0.8/t weekly increase, up to US$ 244.8/t. On November, fieldwork progress was interrupted by heavy rains that also damaged the newly sown fields in Argentina's core productive region. Some crops were completely lost and could not yet be replanted due to excessive soil humidity. In addition to this, second soybean crop is delayed as wheat harvest couldn't take place yet. According to the Secretariat of Agribusiness, Argentine farmers had sown 39% of the intended area by November 22.

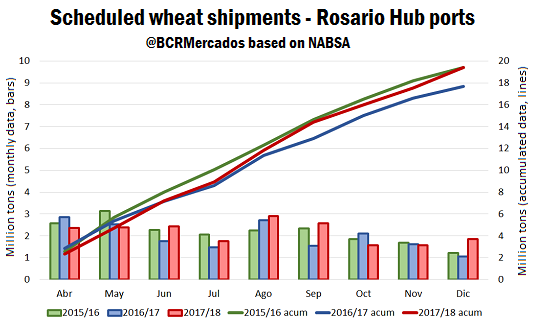

Corn crops, on the other hand, are in much better conditions if compared to soybeans as corn was planted before the heavy rains. Although there were some crops affected by hail, most of them develop with sufficient reserves to face blooming. Corn price on Thursday was US$ 137.3/t, showing a weekly increase of 5%. As for new soybean crop commercialization, MATba April future increased US$ 1.5/t during the past week, up to US$ 144/t, and MATba July future rose by US$ 1.7/t reaching US$ 140/t. Competitive export prices for Argentine corn on October and November resulted in bulky shipments abroad. According to NABSA data, 1.85 million tons were shipped from the Rosario Hub terminals in November only, surpassing previous November shipments. What's more, accumulated shipments this year from the start of the commercial cycle in March, equal last 2017's shipments, even though corn production was 16% lower this season because of the drought.