Argentina-China ocean freight increased by 15% in three years

JULIO CALZADA - BLAS ROZADILLA

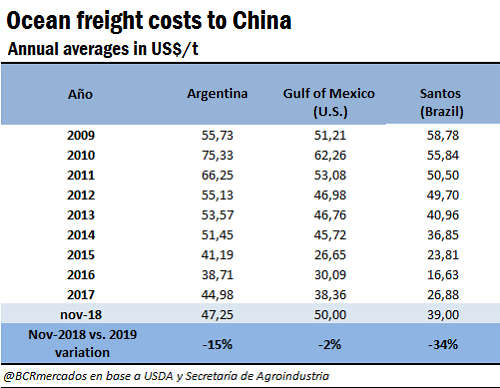

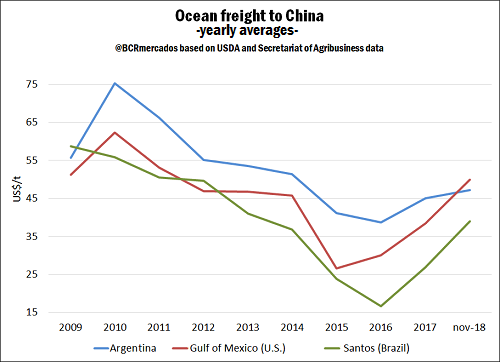

Transport costs are higher for less developed countries than for developed countries. Argentina is a price-taker player in the international grain market; therefore, it is vital for the country to reduce the logistic cost of maritime transport as much as possible. High freight costs reduce local producers' income, which in Argentina represent a great source of investment, employment and economic dynamism. In 2018, ocean transport lost profitability due to the increase of oil prices. According to "Review of Maritime Transport 2018", despite the improvements of freight rates, the latest rise in fuel prices could seriously affect the profitability of the shipping lines. Last year, the bulk carrier market recovered following a significant growth of the demand, which is expected to persist in 2018. The growth of dry bulk demand exceeded the growth of the fleet, since the demand for basic products increased. As for the projections, it is expected that for the dry bulk market to continue to grow in 2018, underpinned by a projected cargoes growth (4.9% between 2018 and 2023) and a moderate projected growth of bulk fleet (3%). Nevertheless, current US-China trade war may bring down demand and drag freight rates downwards. In spite of the increase of bulk freights in 2017, in the last 9 years the maritime freight from our country to China has decreased by 15% in nominal terms; going from US$ 55/t in 2009 to US$ 47/t in November 2018. Argentina gained competitiveness regarding the United States but lost ground if compared to Brazil, where freight rates became cheaper. The table shows the evolution of ocean freight costs per ton from the three main soybean exporters in the world –US, Brazil and Argentina- to China. While Argentina gain competitiveness regarding US freight, Brazil was the country that reduced its ocean freight the most in the considered period, by 34%. In nominal terms, Argentina-China freight fell by 15% in the past 9 years (from US$ 55/t in 2009 to US$ 47/t in November 2018). However, the decrease is even sharper (37%) if we compare the current freight rate with 2010 cost (post 2008/2009 international financial crisis, ocean freight rates reached a maximum.

Argentina is likely to increase its soybean exports to china amid US-China trade war and the removal of the local differential taxes system in the soybean complex. However, the country's disadvantageous position compared to its competitors due to its geographical location, result on higher transport costs.

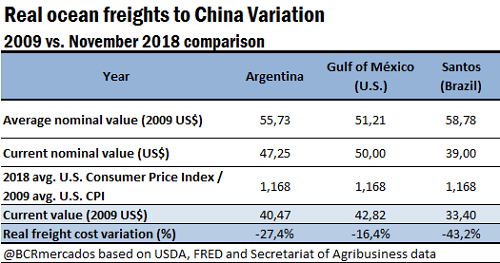

Now, considering international inflation, the 15%-drop is –in real terms- a 27% slide. The current US$ 47.25/t freight rate from Rosario to Shanghai measured in 2009 dollars is US$ 40.47/t. Thus, in real terms, average freight costs between 2009 and 2018 fell by 27.4%. This represents a significant improvement for Argentina and has a positive impact on farmers and local economy.

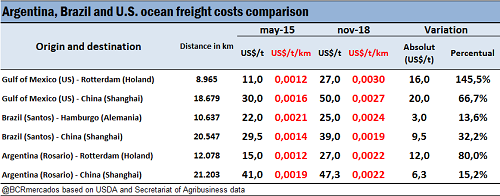

Despite this improvement, Argentina-China freight rates have increased in the past 3 ½ years, by 15%. The rise in Argentina-Europe ocean freight cost in this period is even greater: 80%; negatively affecting the country's grains export complex. However, by comparing Argentina, U.S. and Brazil freight costs to China we notice that the one that experienced the lowest increase was Argentina (15% rise vs. Brazil 32% and in Brazil and 66% of the United States). Regarding ocean freights to Europe, Brazil's freight recorded the lowest increase in the last 3 ½ years (13%), followed by Argentina (80%) and the United States (145%).