2018/2019: Oilseed crushing would remain low in Argentina

JULIO CALZADA - FEDERICO DI YENNO

Several factors contribute to Argentina's decreasing crushing performance.

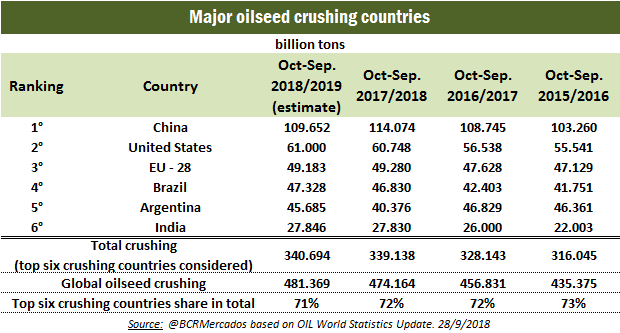

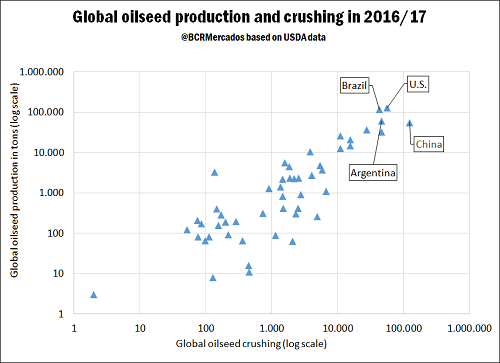

In 2017/18 cycle, Argentina fell from the fourth to the fifth position among major crushing countries. The country is likely to keep the fifth place during the current cycle, processing about 45.6 Mt. China, U.S., E.U. and Brazil lead the ranking.

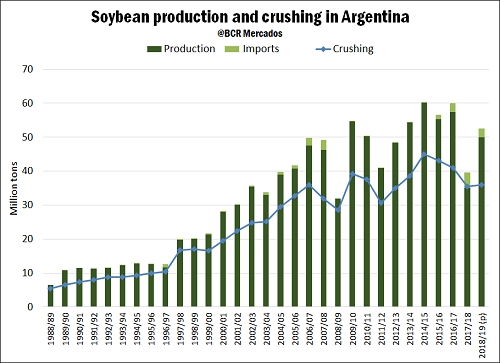

So, why is Argentina losing ground in terms of oilseed crushing as worldwide crushing increases year after year? In the first place, the country suffered the worst drought of the last 50 years in 2017/18 season. The adverse weather led to a cut in soybean production of 20 Mt. Therefore, it is expected for crushing to fall this cycle due to a smaller harvest. Secondly, it is usually very difficult for production to recover in the cycle that follows a severe drought. Furthermore, current cycle's situation is even more complex for farmers due to the high interest rates scenario that limit credit possibilities.

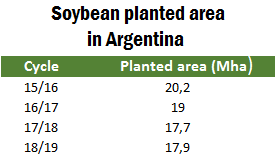

In the third place, in recent years, Argentina has been planting less soybean, which affects directly the local crushing industry. Soybeans planted area in 2015/16 was about 20.2 million hectares (Mha), and from then on soybean planted area decreased, falling to 17.9 Mt in 2018/19.

Thus, a lower local production would led to a smaller crushing activity. Given the estimated 17.9 Mt planted area, the expected production would be around 50 Mt.

Last but now least, the removal of differential export taxes in the Argentine soybean complex will result on lower crushing activity in 2018/2019 and higher exports of unprocessed beans.