Due to the increase in ocean freight, it is no longer more expensive to carry grains by truck from the North of Argentina to Rosario hub than from there to China

The weigh of logistic and transport costs in Argentina has historically been a reason of concern for the agricultural sector on its whole, but particularly for the producers in the North of Argentina, due to the long distance the grains must travel to the port.

In this article, we analyse the incidence of the truck freight for grain transport, with a special emphasis on the goods that must be carried from the most port-remote areas in the North West and North East of Argentina. For the sake of context, a comparison of international ocean freight costs is performed, as well as with the main grain-exporting competitor countries.

1. The incidence of long-distance truck freight equals three times the cost that face the producers in the Core Region (180 km from Rosario hub).

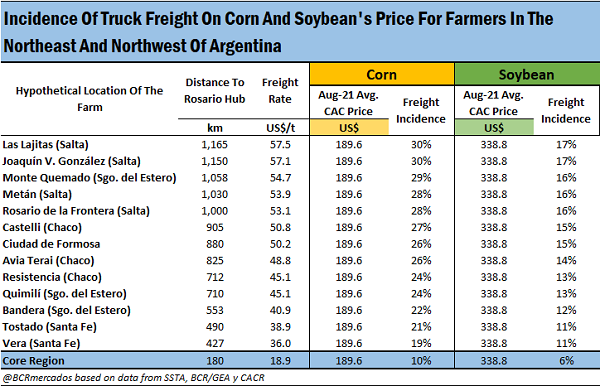

If we take as a basis the official freight rates published by the National Transportation Under-secretary (SSTA, for its Spanish acronym) converted to US dollars at the exchange rate Communication A3500 of the Central Bank of the Argentine Republic (BCRA, for its acronym in Spanish) and compare them to the grain reference prices of the Cereal Arbitration Chamber of Rosario (CAC, for its Spanish acronym) of the Rosario Board of Trade (taking August price), we observe that the cost of transporting grains from the areas most remote from ports has a high incidence on the price of goods. For example, the cost of carrying goods by truck from the province of Salta (towns like Lajitas or Joaquín V. González) to Rosario hub represents 30% of the price of corn and 17% of the price of soybean.

This incidence equals three times the one observed in the case of producers in the Core Region. If we assume a distance of 180 km to Rosario hub, the costs of transporting the grains from that region to the ports and facilities in the Up-River Paraná ports represent a 10% for corn and 6% for soybean. In the case of towns located at an intermediate distance, like the ones in the North of Santa Fe (such as Vera and Tostado), the incidence of the cost of freight on the board price double the ones in the Core Region.

On the other hand, it is interesting to analyse the evolution of the costs of transport in a context of international rise of grain prices. If we carry out a comparison to the situation in November 2019, analysed in the Weekly Report N° 1937, we can observe that, although the average board prices of corn and soybean are 29% and 35% above the ones registered then, the cost of the freights increased in similar proportions (36% from Las Lajitas and 31% from Vera, to quote as an example). This way, the incidence of the costs of freight on the board prices of grains has remained virtually in equal proportions to the ones registered at that time.

2. Due to the strong increase of the ocean freight, it is no longer more expensive to transport grains from the North of Argentina to the plants and port facilities in Rosario hub than shipping them to China, although it is more expensive than shipping them to Rotterdam.

In previous years, it has been commented in this report that transporting a ton of grains by truck from the most remote regions in the North of the country to the port terminals of the Up River Paraná region implied a higher cost than shipping a ton by sea to China. Although this continued to be the case a few months ago, the prices of ocean freight rocketed since May, turning back the situation.

This is an analysis that must be taken with precaution and with a relative outlook, since it compares an international ocean freight transport with a national land (truck) freight transport, where the cargo volumes are absolutely different.

Pressed by a higher demand of iron ore after the building of infrastructure was reactivated in several regions of the planet, the freight for ocean bulk cargo transport reached maximum levels in 11 years by the beginnings of July and, and although they receded slightly since those peaks, they maintain considerably high values.

In the following chart, there is a detail of the costs per ton in dollars of transporting grains from various towns in the North of Argentina to Rosario hub, and the cost of transporting them from there to the port of Dalian in China. As can be seen, the ocean freight to China measured in dollars per ton is above the truck freight from any origin.

However, if we go back to May 27th, the ocean freight to China was US$ 56.36/t, below the 57.10 that cost to carry grains from Salta to Rosario. Furthermore, if we go further back in time to April 13th, we can see that the ocean freight to Dalian was US$ 47.30/t, so it was cheaper to transport the grains by ship through the more than 21,000 km that separate Rosario from that Chinese city than to transport them to the Up-River Paraná ports from any distance over 775 km.

If we now change destination and compare the truck freight in our country to the cost of ocean freight to the port of Rotterdam, the situation changes. Transporting agribusiness products by ship from Rosario hub to the main port of entry to the European market is cheaper than bringing them to the Up-River Paraná ports from any distance over 320 km. Besides, covering by truck the 1,150 km that separate the town of Joaquín V. González in Salta from Rosario hub costs almost twice as much as the transport by vessel over 12,000 km to the main port of the old continent (US$ 57.1/t vs US$ 29.4/t).

3. The truck freight cost in Argentina is higher than in the main competitor grain-exporting countries.

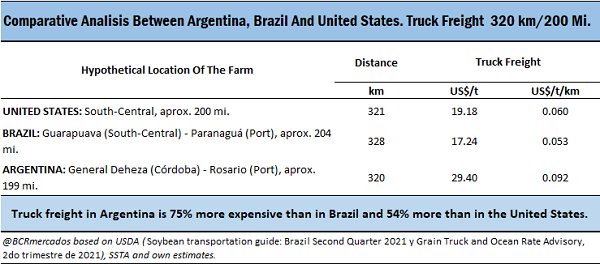

In order to have a notion of the situation in the main competitors of Argentina, it is convenient to compare what happens in Brazil and the United States. To that end, we proceeded to compare the cost of freight for a distance of 320 km or 200 miles in the three countries, and a distance of 1,150 km between Argentina and Brazil (the United States was not included in this comparison since in long distances, the North American country opts for another type of transport, such as train or barges).

In the following chart, there is a comparison of the costs of transporting by truck a ton of grain over a relative short distance of 320 km in each of the three countries. Currently, the cost in dollars per ton per kilometre covered in Argentina (US$ 0.092 /t/km) is 75% more expensive than in Brazil. This gap in costs between both countries has been enhanced from the beginnings of 2020 to date, due to the depreciation of the Brazilian Real, which has lowered costs measured in dollars.

As for freight in the United States, the cost in dollars per ton per kilometre covered for a distance of 321 km, approximately, rises to US$ 0.060 /t/km, about 54% less than the cost in Argentina. In contrast to what happened in Brazil, the cost of the truck freight in the North American country registered a strong increase of over 50% in recent times, along with the rise of domestic prices of fuel in that country.

If we extend the analysis to a freight covering a longer distance (1,150 km), the gap is reduced in relation to the costs of our neighbouring country, although it remains considerably higher. While in Brazil the cost of freight for long distances is US$ 0.030/t/km, in Argentina it is US$ 0.050/t/km, that is to say, 65% more expensive. This contrasts heavily with what happened in November 2019, when the long distance freight in that country was 8.3% above Argentina’s. This is due to the mentioned depreciation of the Real during the last year and, back then, the Argentinian peso had suffered its own depreciation, making the cost of freight in our country particularly cheap when measured in dollars.

4. Final conclusions

It is imperative to reduce the logistic and transportation costs that the producers in the North of the country must face in order to carry their goods to Rosario hub. For crop season 2020/21, the North region (comprising the provinces of Salta, Tucumán, Santiago del Estero and Chaco) (had a total production of 4.7 Mt of soybean and 4.5 Mt of corn. From that production, it is forecast that 3.4 Mt of each crop are destined to export, so it is 68 Mt of grains that must suffer the heavy weight of the freight cost for the distance. This without taking into account the remaining crops obtained in this region that are destined for export. Most of this goods arrive by truck, when the ideal would be that, due to the great distance, they were transported by train or barges, depending on their origin. Argentina is making progress with the Rehabilitation of the Belgrano Cargas and the famous “T” or “L” that joins Joaquin V. Gonzalez-Avia Terai-Rosario hub via an agreement with the CMEC Corporation from China. This agreement allowed for the incorporation of 3,500 wagons, 107 engines, 1,200 km of rails in a “T” that comprises 1,593 km of railways under construction. All this infrastructure is operated by the state-owned company “Trenes Argentinos Cargas”. Provisions have recently been made to advance with the “Open Access” system, where new operators could be incorporated in a railway network managed by the National State.

Under no circumstances should this be read as a message in detriment of the truck as a means of transport, but as an advocacy for the complementarity that should be achieved in Argentina by the truck, railway and barge transportations, with the aim of implementing an integrated system that achieves a higher efficiency and allows for the minimization of logistic costs. The truck has a dominant role in the cargo transport in Argentina, and in the national economy, but in long distances, it is necessary to develop railways and river transports that allow Argentinian grains to gain a higher competitiveness.