Wheat shipments in December double those of 2020, but are below previous years

Production in the current crop will reach a historical record and the advance of the harvest remains in line with what occurred in previous years (in the area of influence of the Up-River, 92% of the area has already been harvested, just as the average of the last five crops). However, after starting November with a fast rate of arrival of trucks to the port terminals of the region, above the record of previous years, since the beginning of December the entry of cereal exhibited a slight deceleration and lagged behind the records of previous crop seasons for the same date.

Considering the trucks that arrived by 7 a.m. of each day, the accumulated from November 3rd to December 16th amounts to 39,804 trucks, below the 2018/19 and 2019/20 crops in the same period. Logically, the current records of the 2021/22 wheat entry exceed by far the volume of the cereal received a year ago, when the meagre production of the central and northern region of the country, added to the union conflicts that paralysed the region's ports for practically the entire month of December, resulted in a sharp drop in truck entry (20,029 units, virtually half of what entered this year).

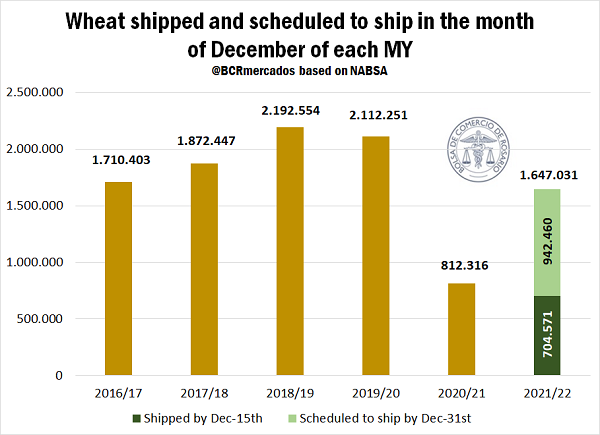

This situation in land logistics is also reflected in the sea transport of the cereal. Taking into consideration the wheat ships dispatched between December 1st and 15th, and what is scheduled to be shipped between the 15th and 31st of the month, 1.65 Mt of cereal will be exported, more than doubling the volume dispatched throughout the month of December 2020. Despite this great year-on-year growth, the volume to be shipped in the current month would be lower than that shipped in December of the previous four crop seasons (2016/17 to 2019/20).

Part of this lower volume dispatched compared to previous years is due to the good Australian wheat production for the new crop season. As commented on several occasions, in 2018 and 2019 a severe drought affected the crops of the oceanic country, which opened opportunities for Argentinian wheat to cover new markets, particularly in Southeast Asia. However, in 2021/22 Australia would obtain the largest harvest in its history, recovering its usual customers and representing a strong competition for Argentinian wheat in those countries, given its geographical proximity and free trade agreements. In fact, Argentinian shipments to Southeast Asia in the first month of the 2019/20 crop reached 630,000 t, while in 2021/22 they are forecast to be 320,000 t.

On the other hand, shipments to Africa and South America, particularly Brazil, have also decreased. It is forecast that in the opening month of the trade year 2021/22, 570,000 tons of national wheat will be shipped to the African continent, while in the 2017/18 and 2018/19 crops, about 850,000 tons were shipped each December. Regarding shipments to South America, between what has already been shipped and what is scheduled to be shipped until December 31st, they total 657,000 t, while in 2019/20 they totalled 920,000 t. Here the variation in shipments to Brazil stands out, which in the current month of December would be 380,000 t, contrasting with the 660,000 t of 2019/20 wheat shipped in December 2019.

As for the external sales of the cereal, the news are, paradoxically, the lack of news. After a strong acceleration in the record of Export Sworn Statements (DJVE, for its Spanish acronym) between September and October, which led 2021/22 to set a record for the time of the year, with 9.1 Mt declared, November ended without new external sales, and so far in December only 1,618 t were recorded. Therefore, the sales volume of the current crop season was lower than in 2019/20.

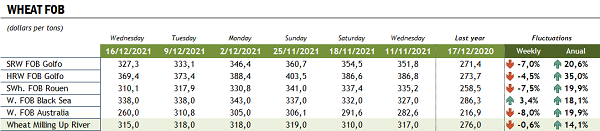

The pause in the record of export sales occurs despite the fact that national wheat was recently found among the cheapest in the world. Taking FOB prices for nearby shipment in the ports of the main cereal exporting regions, Argentinian wheat remained competitive during November, with prices below France, the United States and the Black Sea. However, Australian wheat was consistently below the FOB price in Argentinian ports and even in the last week they fell considerably.

Finally, with regards to prices in the local market, after having closed on Friday at a monthly maximum (US$ 241 t), the equivalent price in dollars of the Cereal Arbitration Chamber of Rosario was uneven, falling a few dollars on Wednesday to US$ 237/t and closing on Thursday at US$ 240/t. However, it is worth mentioning that current prices are the highest in history for the first month of the crop season.

MAGyP will establish balance volumes of wheat and corn

Today, Friday, December 17th, the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, after its Spanish acronym) published Resolution 276/2021, where it determines that, for the purposes of predictability, the Undersecretariat of Agricultural Market of the MAGyP will begin to publish balance volumes corresponding to products of agricultural origin included in the regime of Law No. 21,453 (Wheat for bread, bulk with up to 15% bagged – NCM 1001.99.00 and Other corn (grain), bulk up to 15% bagged – NCM 1005.90.10).

The aforementioned Undersecretariat will summon an Advisory Council made up of the sector boards of the chains of the corresponding agricultural products, in order to receive contributions from the sector.

The external sales yet to be registered may not, as a whole, exceed the balance volumes determined by the Undersecretariat, with an additional margin of up to 4% for operations of insignificant amounts. However, the external sales of the included products, when 90% of the balance volumes are reached and/or the 4% corresponding to the additional margin, they must be carried out in accordance with the special regime DJVE-30. That is to say, once 90% of the volumes established by the Secretariat are completed, the remaining 10% and the 4% corresponding to that additional margin must be registered with a nominated ship and verifiable physical purchases.

In addition, in the event of changes in production and/or consumption that impact the balance volumes, the Undersecretariat will proceed to publish new volumes.