The rains of the week strongly boosted the development of coarse grain crops. Climatic conditions and soil moisture have been assisting soybean and corn 2021/22, according to the latest weekly report from the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym). In this sense, while the seeding of corn continues, the already planted soybean is getting strong.

In this context, as of December 16th, 2021, the sowing of the oilseed is, in relative terms, slightly below the level of previous years, with 69% of the area to be planted and reaching a minimum since at least the 2002/03 crop season. Considering that the total area to be sown is forecast downward with 16.29 million hectares and at minimum levels since the 2006/07 crop season, the area implanted at present (11.24 M ha) is the lowest value in the last 15 years.

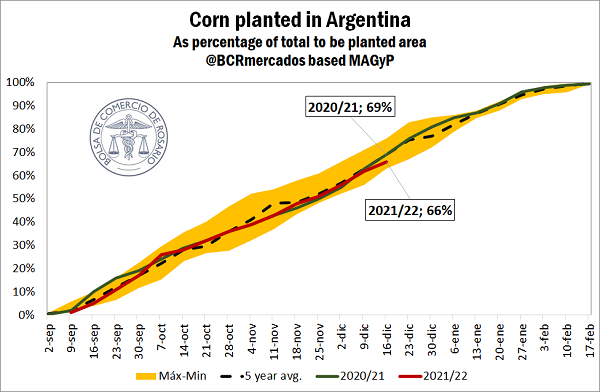

On the other hand, the sowing of corn 2021/22 is also progressing, although with different outlooks regarding area and production. The yellow bean is currently getting close to covering 66% of the intended area, which would officially constitute the second highest on record measured in hectares. However, just as with soybeans, the inadequate moisture levels in the soil delayed in some delegations the faster progress of corn planting labour, with some flooding in the south of Córdoba and the northwest of Buenos Aires. At the same time, in some specific areas there were inadequate to insufficient water reserves, which also prevented a fast progress of the grain planting, such as in the provinces of Santa Fe and Entre Ríos.

Soybean crushing gives good signals to external sales

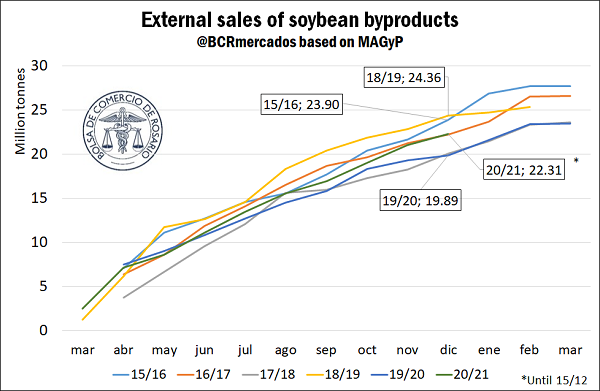

With more than 22 Mt accumulated in Export Sworn Statements (DJVE, for its Spanish acronym) of soybean by-products 2020/21, external sales continue to exceed comfortably the levels of the previous crop season. However, at present, the volume of external sales is below the 24.36 Mt reached in the 2018/19 crop.

Also, with very close crushing levels, we do not rule out that the current crop exceeds 2015/16 crop season. Even with more than three months to go until the end of the 2020/21 trade year, a continuity in the export dynamism could be expected in view of the high levels of soybean industrialization, with the possibility of continuing to break the records of previous years.

Meanwhile, external sales of soybean oil already accumulate 4.45 Mt, a figure below the 4.66 Mt of the 2019/20 crop and the 4.85 Mt of the 2018/19 crop. The commercial volume of oil is also strongly tied to crushing levels, so a rebound in external sales in the coming weeks is not ruled out either.

The 2020/21 soybean accumulates external sales for 5.2 Mt in almost 8 months of the crop season. In this way, we can observe the lowest level of sales since the 2017/18 crop season, which was affected by a severe drought. Regarding the advanced external sales of the new crop, soybean 2021/22 barely accumulates 40,000 tons registered last month, with no new business recorded in December.

As for the 2020/21 corn, with export sales at its highest levels in history, the realization of new external sales of the cereal is slowing down. Now attention is progressively turning to the 2021/22 crop season, which continues full steam. With over 2.3 Mt registered so far in December, 15.3 Mt of the yellow grain have already been declared for export in the new season. In this way, the coming trade year has been the second highest in terms of external business by this time of the year, only behind the 18.2 Mt accumulated by this time of the year in the 2019/20 crop season.