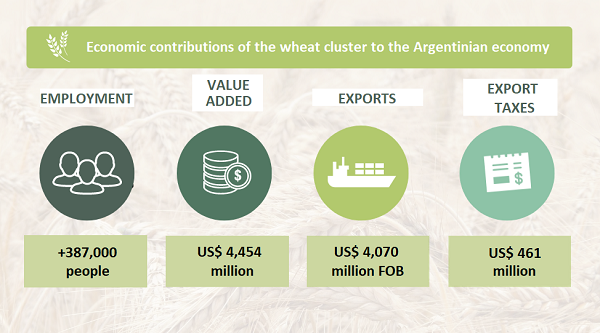

Economic contributions of the wheat cluster to the Argentinian economy

December marks de beginning of a new marketing year for wheat, a cereal with strong historical roots in Argentina, currently grown in 13 provinces. Its impressive territorial expansion makes it possible the direct supply of the 285 milling plants distributed throughout the nation, which supply urban centres. However, the milling industry is not the only source of regional value derived from wheat. Wheat exports, which in recent seasons amounted to more than 60% of the harvest, constitute an important engine of Argentinian regional development.

The wheat cluster stands out in the group of agribusiness chains as one of the most important in terms of socio-economic impact at domestic level. The complex plays a remarkable role in adding value, employing people, contributing to the national treasury and generating net dollars from foreign trade.

In this article we will comment on the main contributions of the wheat chain to the Argentinian economy.

Production

Wheat is the main winter crop, and the third most planted product in Argentina (after soybean and corn). In 2021/22, farmers have covered an area of 6.9 million hectares. With average yields estimated at 3.1 t/ha, the harvest is forecast to reach 20.4 million tons, reaching an all-time high.

Regarding the destinations of domestic wheat, it is forecast that 31% of the total supply is destined to the milling industry and 58% is exported as grain.

Employment and value added

The wheat chain is a very important source of employment for the country, with a particularly relevant contribution to regional economies. According to our own estimates, the wheat complex employs 387,459 people, equivalent to 11.6% of the employment generated by Argentinian agrifood chains.

In addition, the cereal is an important source of added value (AV) for the economy, understanding it as the difference between the final sale value of the produce and the cost of the inputs. In 2018, the wheat chain was the fourth agribusiness chain in terms of creation of added value, accounting for 18% of the AV, according to the report on Agribusiness Value Chains by the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym). That year, the added value amounted to US$ 4,454 million. It should also be mentioned that, unlike what happens in the soybean and corn chains, where the primary activity creates over 80% of the added value, in the wheat chain an important portion of the AV is captured in later stages of its production. The manufacturing industrial stage accounts for 46% of the AV (versus 12% in soybean and 7% in corn), the transportation of the cereal contributes 2% and the primary stage creates only 52% of the value added by the chain to the economy. This higher forward linkage naturally results in greater positive externalities that reach more diversified and dispersed economic agents.

Foreign Trade

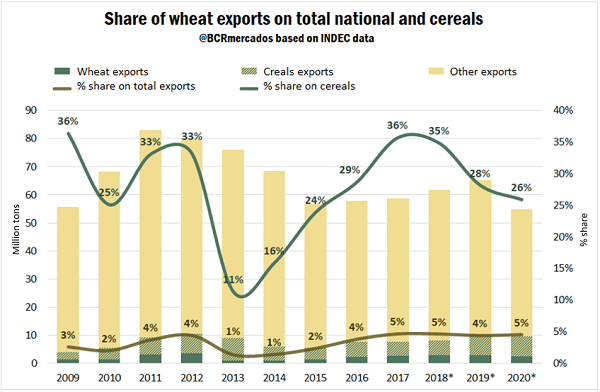

The complex is the fourth agribusiness export complex, behind soybean, corn and cattle. In 2020, the exports of this complex amounted to US$ 2,471 million, representing 5% of the value exported by Argentina, according to the National Institute of Statistics and Census (INDEC, for its acronym in Spanish). In the twelve years considered for the series shown in the chart, the currencies originated by the wheat complex are at a maximum share, which was also reached in 2017 and 2018. However, it is worth noting the substantial difference in context, since in 2020 the complex's share grows to a large extent due to the 15% year-on-year drop suffered by total exports, while in 2017 and 2018 it reaches and sustains its share with growing total exports.

The relative importance of the complex in the cereal sector (which also includes corn, barley and rice) was 26% in 2020. Wheat has been losing its share in recent years, due in part to a lower value exported by the complex, but mainly due to the strong growth experienced by corn exports.

Argentinian wheat exports in 2021/22 are forecast to reach a volume of 13 million tons, for a FOB value of US$ 3,891 million. Also, meal exports are forecast for 550 Mt, for a FOB value of US$ 179 million. Based on these forecasts, and taking into account the Export Sworn Statement (DJVE, for its Spanish acronym) of grains registered up to November, it is forecast that the export duties paid on the FOB value (12%) will reach US$ 448.7 million in this crop, of which they have already been paid US$ 306.8 million. In the case of meal, a contribution of export duties (7%) of US$ 12.5 million is forecast, with export sales just beginning to be noted. Together, the two largest export products of the chain would contribute, only in concept of export duties, US$ 461 million to the national treasury.