Crop season 2021/22 might result in a record income of US$ 36,700 million for export of grains and by-products

As we get closer to the start of the seeding window for coarse grain crops, the producers’ intentions are being defined, and a first approximation can be made regarding what might happen with production 2021/22 of the main cereals and oilseeds in Argentina, and what would the foreign currency input might be in terms of exports.

For the new cycle, soybean is forecast to lose almost 500,000 ha, and 16.2 M ha are to be planted, the smallest area in 15 years. In this way, and considering the trending yield of the last crop seasons, a production of 49 Mt of soybean are forecast for the new crop. This drop in the soybean area contrasts with the rest of the main coarse crops: wheat is forecast to grow 8.5% with a total of 7.9 M ha planted and 6.9 M ha harvested, which would allow to reach a record production of 56 Mt; sorghum might increase its area up to 1.1 M ha (12% more than in the previous crop) and a forecast production of 3.3 Mt; and sunflower might increase 20% to reach 1.7 M ha planted, which represents a production of 3.4 Mt.

With regards to the winter crop, cards have already been played and now everything depends on the quintessential uncontrollable variable for the farmer: the weather in the next few months. The rains during the first days of September have been welcome with open arms by the crops, keeping the productive outlook a promising one. Wheat aims at achieving a record production of 10.5 Mt, while barley might reach 4.5 Mt.

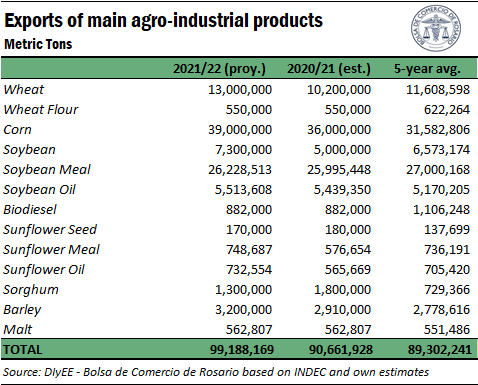

Based on these production estimates, total exports are forecast in 99.2 million tons for the main areas of the agrifood chains, which might turn into the second highest record in history, distributed according to the chart below. Only crop season 2018/19 exceeded in quantity the export sales forecast for the new cycle, with 100.9 Mt. Let us hope that the weather does not play against this chance.

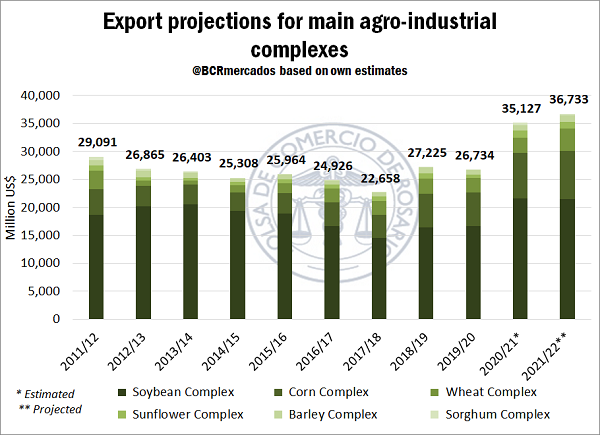

Therefore, based on production and export forecasts of the main crops, at current prices, the Argentinian agribusiness complex might achieve a foreign currency income of US$ 36,700 million, if we add up the main grains and their by-products. Should this figure be achieved, it would exceed in over US$ 1,600 million the mark of the current crop, and it would be a historical maximum in terms of export value of the main complexes of the sector.

Although the average export prices of the vast majority of grains and by-products will be slightly lower in the next business cycle in comparison to the ones received in the current crop, the higher production forecast would allow to compensate for the drop in prices.

In the case of the wheat complex, the forecast value of exports of the cereal for 2021/22 would reach US$ 3,783 million, over US$ 1,200 million more than in the previous crop season. This is due to two joints factors. On the one hand, deferred FOB prices of the cereal for the new crop remain high. On the other hand, in the presence of a promising productive outlook such as the current one, exports of the cereal during the crop season are forecast in 13 Mt, an increase that might reach 27.5% in comparison to the previous crop and a historical record. Exports of wheat meal, in the meantime, might reach US$ 143 million, slightly below the figure of the current season.

As for the corn complex, forecasts for crop season 2021/22 indicate that exports of the cereal will generate a foreign currency income of US$ 8,660 million, US$ 873 million more than in 2020/21, and it could turn into an absolute record for the yellow beans. Unlike what happens with wheat, deferred FOB prices for the next crop are below the average export prices of the current crop season. However, the higher planted area and, consequently, the higher production, could result in an exportable balance of 39 Mt, 2.5 Mt over the current crop, which is why this higher volume might compensate the drop in export prices.

Regarding the soybean complex, the country’s main export complex, for crop 2021/22 it is expected that the value of exports remains virtually identical to the one forecast for the current crop, reaching US$ 21,470 million. Here, again, a slight cut in FOB export prices for the main products is compensated almost entirely by the increase in the forecast exportable volume. Soybean is forecast to reach US$ 3,520 million, 33% more than in the current crop. This is due to the fact that, based on production estimations, exports for 7.3 Mt are forecast, exceeding widely the 5 Mt estimated for the current crop. With regards to soybean meal, during crop season 2021/22, 26.2 Mt are forecast to be exported, which would generate a foreign currency income of US$ 10,124 million, that is, US$ 558 million less than the ones received for the 26 Mt that will be exported during the current crop. Last, oil and biodiesel might reach exports for US$ 6,412 and US$ 1.418 million, respectively, slightly below the figure forecast for the current cycle.

Sunflower and barley complexes join in with US$ 1,100 million each. With regards to the oilseed, the exports for the sunflower seed are forecast in US$ 91 million, pellets shippings are forecast in US$ 183 million, and oil in US$ 916 million. For the three products, the forecast value of exports presents a slight drop with regards to the estimated for the current campaign. This is due to the fact that, although an increase in the shipped tons is expected, export prices show a drop that overcompensates the rise in volume. As for the barley complex, exports of the grain might reach US$ 904 million and exports of malt, US$ 261 million. Unlike what was mentioned earlier about sunflower, exports of these two products might increase in the new crop season, since the prices will remain virtually similar to the ones in the current crop, but it is forecast a 9% rise in the exported amounts of the product due to the higher production obtained.

Last, the sorghum complex might export US$ 319 million, 84 million less than in the current crop. Here, unlike the forecasts for the wide majority of the products included in this analysis, the forecast export volume for this grass for crop season 2021/22 falls in comparison to the current crop, and would reach 1.3 Mt. However, FOB prices for the next crop season are forecast slightly above the ones received in the current season, which is why they partially compensate the fall in tons.

If we observe the evolution of the foreign currency generation by the main agribusiness complexes, we can see that the rise in prices of the main products since last year has boosted a strong increase in the value of exports. Besides, for the new crop season a rebuilding of the volumes shipped might overcompensate a slight cut in prices that, it is worth noting, remain considerably above the average trend.

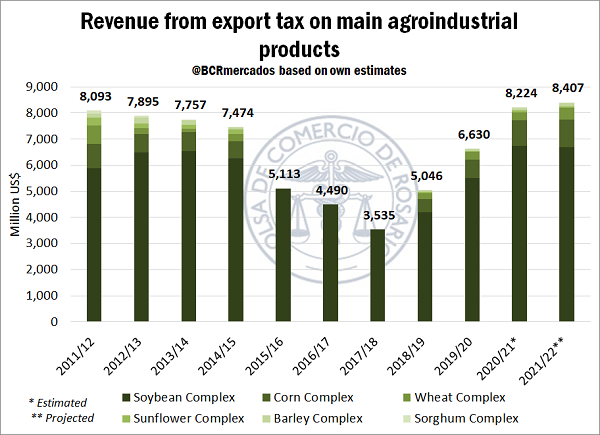

Should these forecasts are made effective, the State might collect in export duties a total of US$ 8,400 million, over US$ 150 million above the forecast value for crop season 2020/21. Besides, it could be the highest amount in ten years to enter the State coffers for this concept. Another point to highlight is that, given the higher production and exports, corn might exceed US$ 1,000 million in contributions for export duties for the first time in history.

Although there still is a long way to go, and we need to see if the weather accompanies the crop in order to obtain this production increase, crop season 2021/22 looks promising, and the entry of foreign currency in the chain heads to reach a record, which is particularly important in a context of macroeconomic instability and the shortage of dollars to satisfy the needs of the local productive fabric.