Argentina heads to resuming a path of growth, while facing key challenges for 2022

Since the abrupt fall in economic activity in Argentina by May 2020 due to the COVID-19 pandemic, our country achieved a significant economic rebound, ending that year only 3.1% below the month of February 2020. That is, as circulation restrictions were released, the activity resumed its dynamism, which was sustained in the current 2021. By September, a maximum level of activity was reached since July 2019, although it registered a slight drop in October after four consecutive months on the rise.

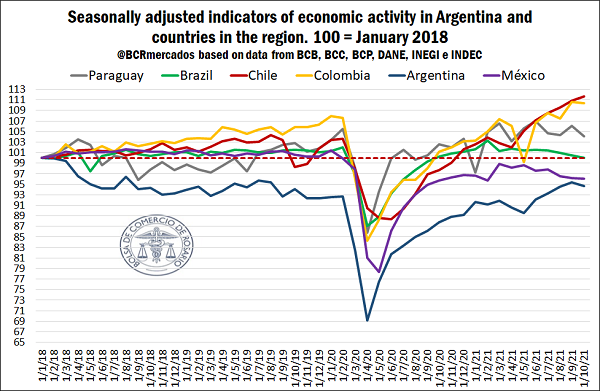

If a broader period is analysed since the beginning of 2018, it can be observed that our country had been going through an important negative economic course with a decline in activity, therefore, the arrival of the pandemic ended up generating a “double crisis”, which had a great impact on the set of socioeconomic indicators that were partially alleviated with the assistance of the State. If we compare with the main countries in the region that present similar activity indicators, by January 2020 all the countries analysed had a level of activity above January 2018 except Argentina, which stood at 7.4% per year below said base month.

In this way, the pandemic implied a more severe fall in activity for our country compared to the region, as can be seen in the preceding graph. In turn, as of October 2021, only Mexico and Argentina were below the record obtained at the beginning of 2018. On the other hand, among the countries that are achieving the best performance are Chile and Colombia, which present levels of activity above pre-pandemic and in a marked path of economic growth. At the same time, the stagnation of its recovery since February 2021 stands out in Brazil, which has been consolidated in recent months with activity setbacks. In this sense, this data must be analysed with great care since what happens in Brazil has a great effect on the future of economic activity in our country, in the face of strong bilateral trade ties.

Regarding the future prospects of the Argentinian economy, first of all, the forecasts for 2021 reflected in the 2022 Budget Draft mark a recovery of 8% for Argentina's Gross Domestic Product (GDP). This projection is the same as that made by the Organization for Economic Cooperation and Development (OECD) and slightly above the 7.5% forecast by the International Monetary Fund (IMF). However, according to statements made by the Minister of Economy, it is probable that the year 2021 ends with a higher level of recovery than previously forecast.

Facing 2022, the main international organizations are more cautious than the local government, since the IMF and the OECD forecast that the domestic economy will not be able to exceed its GDP level for 2019. In the meantime, the local Ministry of Economy estimates a growth of 4% in 2022, which would place us 1.2% above 2019.

In this context, in order to achieve a continuity in the recovery in 2022 that allows to resume the path of economic growth, the need to overcome a series of challenges in both the short and medium term stands out, which will be key to not falling again in stagnation.

In the short term, it is imperative to reach an agreement with the IMF and the Paris Club, which clears the maturity horizon and gives greater predictability to external accounts. At the same time, it will be key to maintain a high trade surplus that allows to sustain the imports necessary to preserve growth and that allows, at the same time, a higher level of reserves to provide greater exchange rate stability. While, in the medium term, recovering the fiscal and monetary balance becomes a necessary condition to be able to give sustainability to the public debt and to depend less on the assistance of the Central Bank of the Argentine Republic (BCRA, for its acronym in Spanish). In turn, in relation to the aforementioned, the Argentinian economy has to converge towards a drop in inflation to avoid distortions in relative prices and provide predictability in the value of money to facilitate decision-making, especially at the level of capital investments. Finally, it is necessary to continue with a recovery in private employment, which is still far behind, fundamentally in the face of a heterogeneous recovery situation at the sector level. Hereinafter, these points are analysed individually.

1- Agreement with the International Monetary Fund (IMF) and the Paris Club

In 2020, Argentina managed to restructure its debt in dollars with private creditors in a context of important maturities that were scheduled to be met in 2021, which would have had a serious impact on the external accounts and on the recovery of our country. In this way, after the debt swap carried out, until mid-2024 no significant disbursements should be made for said commitments, which begin to be larger from 2025 onwards. On the other hand, the local private sector was required to restructure its debts in dollars to generate additional relief to the balance of payments.

However, regarding multilateral credit institutions, a new agreement with the IMF still needs to be completed, in order to decompress the important debt cancellations that must begin to be paid to said body as of January 2022. Such repayments correspond to the Stand By loan granted to Argentina in 2018 for US$ 57,000 million, of which US$ 44,490 million were credited. Currently, Argentina is not in a position to repay this loan on the scheduled dates, due to the fact that such an agreement presents a short-term repayment structure with large maturities concentrated mainly between the years 2022-2024.

Following the payment schedule projected by the IMF, in 2021 US$ 5,046 million were already paid, estimated on the base of the current price in dollars of Special Drawing Rights (SDR). Of this total, the majority could be covered with the US$ 4,036 million that corresponded to our country in terms of new distributions of SDRs. Such extraordinary disbursements by the IMF to all member countries was intended to help face the negative effects of the COVID-19 pandemic.

Looking ahead to 2022, Argentina is in a critical situation due to the fact that, although a significant trade surplus was obtained in 2021 mainly as a result of the international rise in commodity prices, the foreign exchange from goods exports were used to face the rebound in imports and other debt commitments. In this way, 2021 ends in a situation similar to 2019, with a downward trend in international reserves and no possibility of meeting the commitments of the first quarter of 2022 with the IMF without a cut in imports of goods and services. In this sense, it is essential to reach a quick and favourable agreement with the IMF that clears the payment horizon for the next few years, considering that on January 28th, 2022, an important maturity of US$ 717 million is approaching.

On the other hand, regarding debt agreements with multilateral organizations, the situation with the Paris Club still needs to be resolved. According to the Congressional Budget Office, by the end of May scheduled maturities were not paid with the Paris Club for a total of US$ 2,437 million, which represents the final payment of the 2014 restructuring agreement. Finally, on June 22nd, an understanding was reached with the member countries of the organization, with the making of two partial payments, in July 2021 for US$ 231 million and in February 2022 for US$ 199 million, which prevents Argentina from defaulting with those creditors. In turn, the cancellation of the remaining capital was deferred until a new payment schedule is defined, with a deadline for the new agreement in May 2022.

2- Sustaining a high trade surplus

In line with the need to improve the payment structure of public debt in dollars with private creditors and multilateral organizations, together with the restructuring of private debt to alleviate pressures on the external sector, maintaining a significant surplus is presented as a key challenge trade in the coming years to meet the import needs for increased activity, production and employment. In 2021, we forecast at the Rosario Board of Trade (BCR) that it will culminate with exports of goods for US$ 77,482 million and imports for US$ 62,536 million, which would allow to obtain an estimated trade surplus of US$ 14,946 million. This figure is the second highest value in the last 11 years.

It is important to emphasize that this year, the evolution of international prices was key to the large increase in the value of exports. Following data by the National Institute of Statistics and Census (INDEC, for its acronym in Spanish), for the first 11 months of 2021, the prices of Primary Products (PP) and Manufactures of Agricultural Origin (MOA) obtained an increase close to 28% compared to the same period of 2020. In this sense, although the "quantities" dispatched increased for the aforementioned items, as in the case of Manufactured Industrial Origin (MOI), without the extraordinary price effect registered in agribusiness goods, the external trade performance would have been very different.

In order to achieve the forecasts made by the government in the 2022 Budget Draft in terms of growth, it will be essential that the international prices of agribusiness goods remain relatively high and continue on a path of increasing the quantities exported in all areas. At the same time, it will be crucial that sector policies are implemented in the short term in activities with great export potential in order to broaden the spectrum of goods that stimulate exports. If this objective is not reached, it will be difficult to increase imports for production, which would be to the detriment of the economic recovery and the growth target forecast for next year.

3- Balancing the fiscal and monetary outlook

On the fiscal front, it is of great importance to achieve a fiscal surplus in the medium term that helps to reach macroeconomic balances in Argentina again. The following chart shows the financial result of the National Public Sector (SPN, for its Spanish acronym) and its respective form of financing since 2015. In this sense, we can see the recurring fiscal deficits in which our economy incurs, which cannot be fully covered with market debt. Therefore, the assistance of the Central Bank of the Argentine Republic (BCRA, for its acronym in Spanish) is resorted to in the form of temporary advances, remittance of profits and placement of bills, which end up having an impact on monetary balances since it is combined with an unstable demand for money, in a scenario of high inflation and lack of confidence in the local currency.

In 2020, a financial deficit of no less than 8.34% as a percentage of GDP was reached. This imbalance, driven by the important aid packages made by the State against COVID-19 and the maintenance of the economy, implied the need for significant assistance from the BCRA, which covered 87.5% with temporary advances and distribution of profits of that deficit. In this way, this situation implied a significant increase in the stocks of monetary liabilities (Passes and LELIQ) as a way to contain a vertiginous expansion of the monetary base, although generating impacts on the expectations of economic agents regarding fiscal and monetary sustainability, which was reflected in the inflation levels of 2021.

However, this year it was sought to mark a path towards fiscal balance with a sharp fall in the primary and financial deficit, where the latter is estimated to be -5.4% at the end of the year. Looking ahead to 2022, the most relevant fact is there was no agreement in the Lower Chamber to approve the budget bill and the 2021 Budget had to be extended. Under these circumstances, our country is not positioned in the best possible way to advance with an agreement with the IMF, considering that the law of laws is a fundamental pillar that seeks to reflect the government's plan in fiscal and economic policy matters.

An important element to highlight is that the bill marks an intention of the government to continue with a downward path in the financial deficit of the National Public Sector (SPN, for its Spanish acronym) (-4.9%), while the intention to continue with a recomposition of local debt market and demand less assistance from the BCRA prevails. If temporary advances and the remittance of BCRA profits are considered, by 2021 assistance to the Treasury was substantially reduced in terms of percentage of GDP with 2.8% according to preliminary estimates. While for 2022, based on the government's growth forecasts, the project stipulates reducing said assistance to 1.8% of GDP and only covering financing needs by the BCRA with temporary advances.

In this way, the need to continue on this path of deficit reduction and financial assistance from the BCRA stands out, in order to channel monetary variables and adjust the expansion of money based on the dynamics of demand by economic agents.

4- Converging towards a price slowdown

After a downward trend in the evolution of the Consumer Price Index (CPI) during 2020, as a result of the strong economic contraction due to circulation restrictions due to COVID-19, in 2021 a strong upward path was resumed in the general level of the national CPI as well as in the category of the core CPI. In the medium term, it will be essential to attack this problem because in recent years higher and higher levels of inflation have been consolidating as a result of macroeconomic disasters that have a concrete impact on the normal development of the economy.

As mentioned in in previous articles, although the increase in the international price of commodities in 2021 has had an impact on price dynamics, the process of sustained and generalized price increases is related to a multiplicity of factors. In the particular case of Argentina, as mentioned above, important challenges must currently be faced at the external and internal level that have repercussions on the formation of expectations for the economic future and, in this sense, also on the dynamics of prices. Therefore, reaching a situation of macroeconomic stability again should be a basic objective due to the important impact it has both on the general level of prices and on economic growth and development.

5- Continue with a process of recovery of private employment

Finally, although the favourable level of recovery presented by the Argentine economy has been commented previously, the result is heterogeneous and the employment data reflect to a certain extent what is happening in the set of economic sectors.

According to the latest data published as of September 2021, the total registered employment is above pre-pandemic levels, with the additional creation of 147,276 jobs compared to February 2020. However, private employment still has to recover 47,131 jobs, being one of the most stable and high-quality occupations. While the great boost in job creation is found in the public sector (↑ 96,120) and the total of freelancers (↑ 149,033). In turn, if compared with March 2018, the private sector is clearly the most affected in absolute terms, since there are currently 339,331 fewer jobs compared to that period. In this sense, there is still a long way to go to rebuild the situation of private activity, being key to boost investment and production growth.

At the sectoral level within the private sector, the most lagging activities are “hotels and restaurants”, “transport, storage and communications”, “community, social and personal services” and “commerce and repairs”. Together, these activities present 99,255 fewer jobs compared to February 2020. In turn, if compared to March 2018, the aforementioned sectors are added to the lag in the recovery in construction and the manufacturing industry, being two activities of great relevance with respect to the revitalization of investment and capital formation.

Thus, if the economy is to continue with the recovery process, policies to empower the private sector will be essential to consolidate the growth of the economy. Likewise, performance in terms of employment will also depend on the result obtained in the set of points described above linked to the macroeconomic situation in general.