The increase of local prices in a context of low transactions volume

FEDERICO DI YENNO - BLAS ROZADILLA

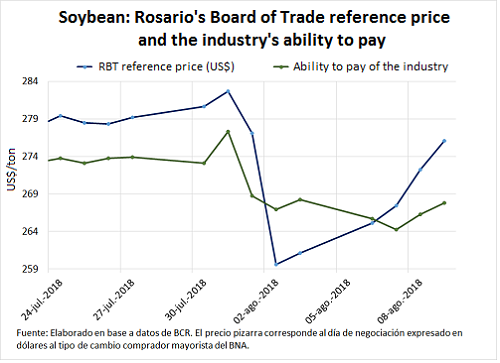

Soybeans outlook On Thursday, August 9, soybeans price at Rosario's Board of Trade was US$ 276/t, US$ 16.50/t (6.34%) above its price on Thursday, August 2. The drop in soybean local prices during the mentioned week was due to the decrease in the by-products international price. The oil exporting industry's ability to pay fell US$ 13/t within a week. The decrease was driven by the fall of by-products prices in CBOT (as CBOT soybean futures fell in US$ 5.6/t), but also by a lower pressure from external demand. The fall on Rosario Hub FOB spot for Hi-Pro soybean meal went from +4 on September futures to -3 within a week.

In addition to the international bearish context for by-products, the demand was reluctant to validate the prices pretended by suppliers, which lead to the fall of soybean price (US$ 261.1/t on Friday, August 3). The limit on prices responds to the tight margin of the industry in a context of cautious external demand and scarce domestic supply. Soybean prices increased by Thursday 9 (US$ 271.5/t), due to the exchange rate and the rise of CBOT prices, even though the volume of transactions was still low. According to the Ministry of Agribusiness data, a price was set on 4 million tons of soybeans already committed during the month of July. The volume of transactions for the new crop season is also low. Soybean Ros05/2019 futures at MATba (Buenos Aires Futures Market) varied during the week, always above the price set on Thursday, August 2. While a week later, on Thursday 9, the price was US$ 282/t, hence there was a weekly variation of 0.5%.

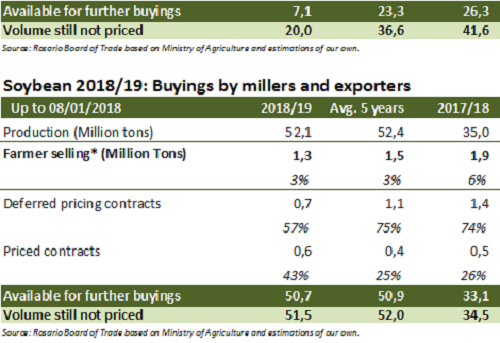

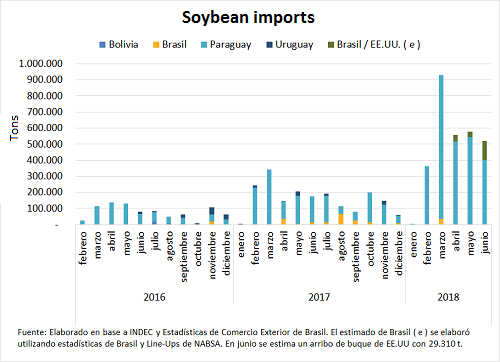

By August 1, 28 MT of 2017/18 soybean have been acquired between the export and industrial sectors, these represent 80% of this year's soybean crop. If considered the grains destined for animal feed production, seeds and those that are consumed inside the farm, there would be very little crop available to commercialize this season. Although this is consistent with the strong productive loss of 2017/18 season due to adverse weather conditions, there must be taken into account previous season's stocks that may strengthen the supply. In fact, according to data from the Ministry of Agribusiness, the industry acquired 1.5 MT of 2016/17 soybean between April 1 and August 1, 2018. Imports are another key factor underlying the supply. In contrast to lower domestic soybean production (and the declining volume of transactions), soybean imports to date grown at a faster pace than in the previous season. Argentine imports of soybean were of 2.94 MT by June 2018. According to the Ministry of Industry and Foreign Trade of Brazil's exports data, in 2018, this country would have exported approximately 500 thousand tons of soybean to Argentina. Sending 410 KT by barge, 51 KT in two ships and 38 KT in trucks. At the moment only 195 KT of soybean have arrived in Rosario Hub's port terminals as the freight takes some considerable time. On another note, there is record of only one vessel from the United States with 29,310 tons, while almost all soybean imports come from the neighboring Paraguay, by barges through the Paraná River. The value of imports is 265% higher if compared with the same period last year (1.11 MT from January to June 2017).

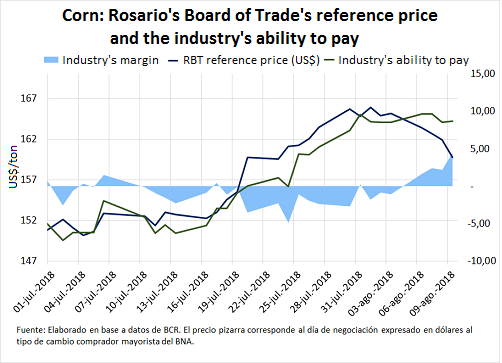

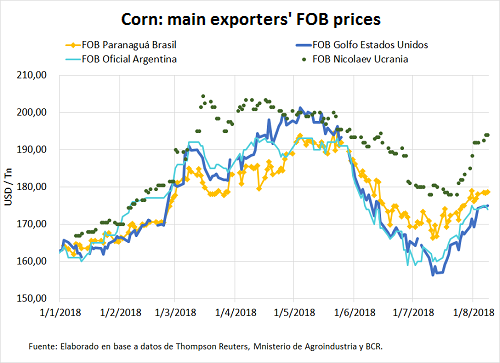

Corn outlook On Thursday, August 9, corn price at Rosario's Board of Trade was US$ 159.7/t, US$ 5/t below its price on Thursday, August 2; reflecting the variation of USD/ARS exchange rate. At Rosario Stock Exchange, both corn and wheat captured most of the attention during the week. In the case of corn, spot positions were preferred to deferred positions. In terms of prices, and unlike soybean, local corn price decreased with respect to the ability to pay this week.

During the month of July corn price reversed its trend in international markets, following wheat's strong upward trend, due to the problems experienced by several important producing countries in the northern hemisphere.

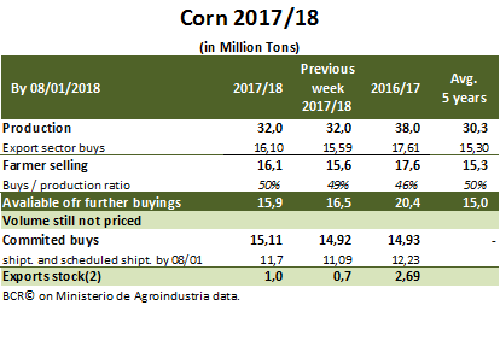

External buys and sales for corn present a rhythm that is similar to last season's. The export sector's buys reached, on 1 August, 16.1 MT. This is equivalent to 50% of the 2017/18 corn season. Current external sales (15.11 MT) surpass last season's committed sales for the same period (while corn exports reached a record last season). This figures show the robustness of the cereal's present external demand.